Euro Gains On Monte Paschi State-Rescue Plan

Talking Points

- The single currency picked up in Asia on news that the Italian cabinet was debating a rescue for Monte dei Paschi DeSiena

- The tottering lender said this week that it had failed to secure sufficient private capital to carry on

- A state lifeline has been the only viable option since

The Euro got a small lift in Friday’s Asian session on news that the Italian cabinet met late Thursday in Rome and agreed at State-led rescue of tottering lender Monte dei Paschi De Siena (known as “Monte Paschi”).

The world’s oldest bank said earlier that it had failed to secure sufficient private capital to keep it going. This probably made government aid inevitable, and indeed it was widely anticipated in the market. Still, investors took heart from the news that Rome is on the case.

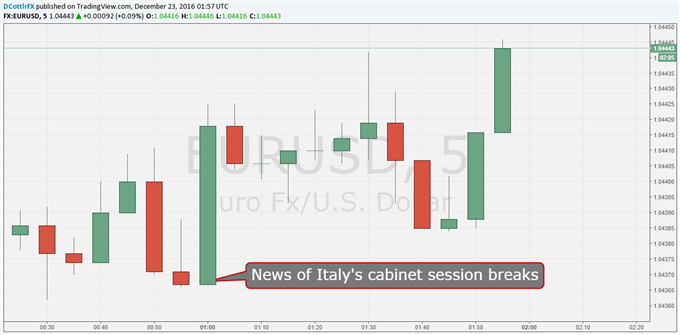

EUR/USD rose from 1.04367 to 1.04439 after the news broke. However, Asian markets are thinned by the looming holiday break which will mean early closures in Auckland and Sydney. Tokyo is out of the game completely as Japan celebrates the Emperor’s Birthday holiday. This may mean that reaction was more muted than it might have been in a more typical session.

On Wednesday, Italy’s parliament authorized the government to borrow up to EUR20 billion ($20.9 billion) to bolster struggling banks starting with Monte Paschi, which has long been the gloomy poster child for Italy’s financial-sector problems.

On Thursday, Monte Paschi itself said that it had managed to raise less than half of the five billion euros in new capital it needed to secure by year-end to avoid being wound down. The bank was founded in 1472 for the provision of charitable loans to the needy, but now finds itself in need of donations.

Many Italian banks have struggled with bad loans, over-staffing and the legacy of Italy’s long economic stagnation. Total bad loans in the sector are reportedly some EUR365 billion, or 17% of balance sheets.

However, Italian shares have risen in recent sessions on hopes of the “benign” state bailout of Monte Paschi which now appears to be in the offing.

Confidence booster? EUR/USD