The USD rally continues as data validates a December rate hike

28 October 2016, 09:25

0

92

The USD rally continues as data validates a December rate hike

The first of three releases of U.S. third quarter gross domestic product (GDP) data will be published on Friday, October 28 at 8:30 am EDT. The advanced GDP is reported 30 days after the end of the quarter. The change in value of the goods and services produced by the U.S. in the third quarter is forecasted to be around 2.5% and signal a turnaround after a slow start to the year.

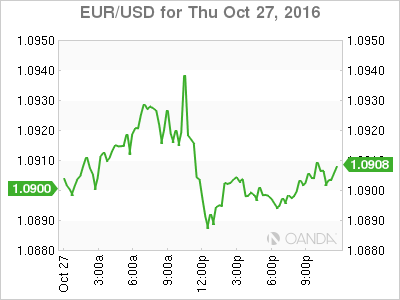

The USD was higher across the board against majors on Thursday as U.S. economic data has been mixed but expected to finish the week on a high note with he release of GDP data on Friday. The CME's FedWatch tool shows a 90.7 probability that the rate will be unchanged in the November 2, Federal Open Market Committee (FOMC) meeting but the Fed futures prices show a 71.4 percent probability of a rate hike in December 14.

Next week's FOMC meeting will be a subdued affair as the Fed will try to minimize any political bias ahead of the U.S. presidential elections on November 8.

Prepare for the US election - Live Market Analysis

On the 8th November, the United States of America will come together to decide the next President. This person will hold the top position as the leader of the world's largest economy. The elections are heating up but how will the markets react following the election?

In this webinar special we will put the markets under a microscope and analyze how the markets are most likely to react with both outcomes.

November 1, 2016 - 4pm PST | 7pm EDT | 7am SGT (Nov 2) | 10am AEDT (Nov 2)

November 2, 2016 - Noon SGT | 3pm AEDT | 9pm PST (Nov 1)