DAX Battle Lines Drawn as Index Looks to Regain 2016 Losses

DAX Battle Lines Drawn as Index Looks to Regain 2016 Losses

- DAX carves monthly opening-range below key resistance

- Updatedtargets & invalidation levels

- Looking for trade ideas? Check out DailyFX’s 2016 4Q Projections

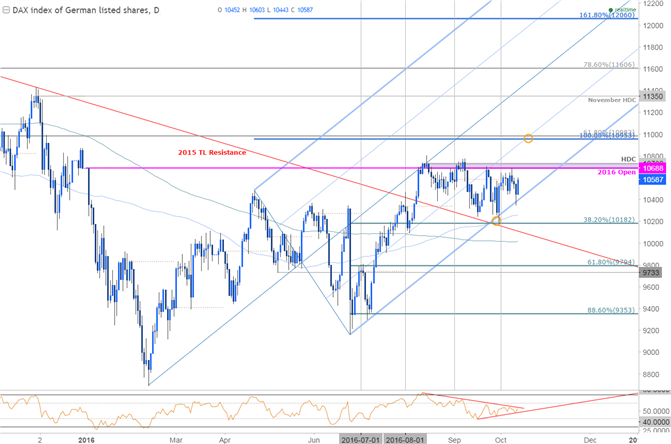

DAX Daily

Broader Technical Outlook: The DAX has been trading within the confines of a well-defined ascending pitchfork formation off the yearly lows with the advance continuing to hold just below key resistance at10688-10730 - a region defined by the 2016 open and the yearly high-day close. A breach above this key threshold is needed to validate the August breakout. Note that the index broke above trendline resistance extending off the 2015 highs (red) back in August with the late-September sell-off respecting this slope as support. Watch for a break of the pending daily momentum triggers for guidance here.

DAX 120min

Notes: A closer look at the index highlights a precise rebound off the lower parallel late-last month with10688-10730 continuing to cap the advance near-term. Heading into the second half of the month the focus remains higher while within this formation with a breach targeting 10953/83 and the November high-day close at 11350.

A break below confluence support at 10182 (bullish invalidation) is needed to suggest a more meaningful correction is underway with such a scenario eyeing subsequent support objectives at 9988 & the 61.8% retracement at 9794.Keep in mind the European Central Bank (ECB) interest rate decision is on tap next week and is likely to fuel added volatility as market participants assess the outlook for monetary policy. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

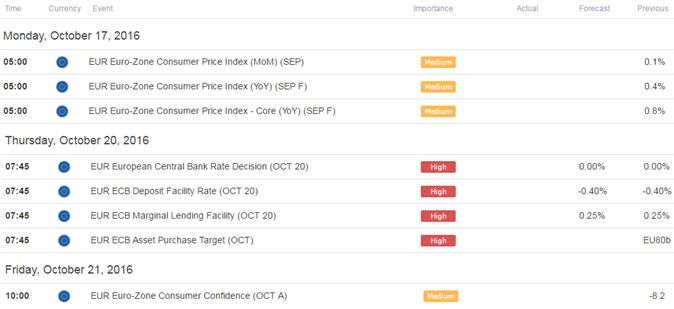

Relevant Data Releases