USD/CAD Loonie Higher as Commodities Rise

The Canadian dollar appreciated against the USD thanks to oil prices gaining as the uncertainty about a U.S. rate hike in June continues. The disappointing U.S. jobs numbers, 38,000 new jobs added in May, were way below expectations and damaged even the most optimistic estimates of a June rate hike. The CME FedWatch Tool is now showing a 3.8 percent probability of a rate hike based on Fed fund futures prices. Ahead of the U.S. non farm payrolls (NFP) report the probability hit as high as 40 percent. The main driver of those estimates were the minutes from the April Federal Open Market Committee (FOMC) meeting which pointed to the U.S. central bank waiting to pull that trigger if the economy recovery. The notes did not contradict the statement released in April, but added more transparency into what the Fed really meant. The disappointing jobs numbers put the June rate hike off the table, unless the Fed feels confident this was just a temporary setback.

Canadian data out this week will focus on employment and housing. The Bank of Canada (BoC) will release the latest financial system review. Jobs data has decoupled from the U.S. and is now one week apart which could boost the loonie if the data shows improvement with a forecast of 1,000 new jobs, but the impact of the Alberta wild fires still to be fully quantified.

The Bank of Canada will get a chance to expand on their views on the economy on Thursday, June 9 when they release the Financial System Review and follow it with a press conference by Governor Stephen Poloz and senior Deputy Governor Carolyn Wilkins. Again the impact of the wild fires in oil producing Alberta will be part of the conversation as energy producers are slowly ramping up production again.

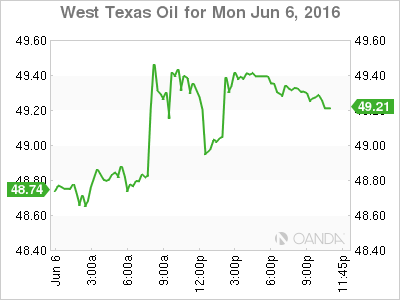

The USD/CAD lost 1.002 percent in the last 24 hours. The pair is trading at 1.2808 and the USD is barely keeping above 1.28 as the price of oil has boosted the CAD. West Texas gained 1.92 percent with the price of crude near the $50 mark. Commodities mounted a comeback as supply is still a concern and the weak NFP numbers took the air out of the USD rally.

With Nigeria and Canada still below their normal outputs and what could be described as a “civil” Organization of the Petroleum Exporting Countries (OPEC) meeting last week the price of oil has taken advantage of the deflated interest rate divergence trend after the disappointing U.S. jobs report. A weaker dollar that might not get the expected boost from an interest rate hike until December, if the Fed wishes to avoid acting too close to a presidential election, could keep oil prices stable as a less combative stance was adopted by Saudi Arabia and Iran during the latest OPEC meeting.

Oversupply continues to be an issue as even Iran has rejoined producers in shipping more crude ahead of schedule as buyers in Asia are taking advantage of discounted prices.

The Canadian dollar will be guided by energy events this week, more than the fundamental data released in Canada, but employment will close out the week with some details around the impact of the Alberta wild fires and their effect on accounting for job creation last month.

CAD events to watch this week:

Tuesday, June 7

12:30am AUD Cash Rate

12:30am AUD RBA Rate Statement

Tentative CNY Trade Balance

Wednesday, June 8

4:30am GBP Manufacturing Production m/m

10:30am USD Crude Oil Inventories

5:00pm NZD Official Cash Rate

5:00pm NZD RBNZ Rate Statement

7:00pm NZD RBNZ Press Conference

9:10pm NZD RBNZ Gov Wheeler Speaks

Thursday, June 9

3:00am EUR ECB President Draghi Speaks

8:30am USD Unemployment Claims

11:15am CAD BOC Gov Poloz Speaks

Friday, June 10

8:30am CAD Employment Change

8:30am CAD Unemployment Rate

10:00am USD Prelim UoM Consumer Sentiment

*All times EDT