USD/CAD: The Bank of Canada will decide on the interest rate

Political instability in Italy and its possible consequences for the European economy forces investors to buy safe assets. Against this background, not only the euro is falling, but also the quotations of commodity currencies, as well as commodity prices, are falling. Against this negative background, the Canadian dollar fell against the US dollar, reaching a 2-month low at 1.3045 on Tuesday.

The US dollar, which also enjoys the status of a safe asset in this situation, continued to grow on Tuesday. The dollar index DXY, reflecting its value against the other 6 major currencies, reached its new annual high of 94.98 on Tuesday.

Nevertheless, on Wednesday the US dollar took a pause and declined from the opening of the trading day. Futures on DXY traded at the beginning of the European session on Wednesday near the mark of 94.35.

Today the publication of important macroeconomic data is expected.

In particular, at 12:15 (GMT) ADP data on the number of jobs in the private sector of the US for May will come out. If they are strong, then the positive trend of the dollar will resume. As a result, the dollar index DXY could rise to 96, according to many economists. It is expected that the number of employed in the private sector of the US rose in May by 190,000 (after an increase of +204,000 in April). Strong ADP data on employment in the private sector will support the upward momentum of the dollar.

At 12:30 (GMT), the Bureau of Economic Analysis of the US Department of Commerce will publish data on US GDP for the first quarter (second estimate). Data on GDP are one of the key (along with data on the labor market and inflation) for the Fed in terms of its monetary policy. In the previous quarter, GDP growth was + 2.5%. The forecast for the 1st quarter of this year is 2.3% (2.3% on the preliminary release). The dollar will decrease only if the data prove to be much worse than the forecast.

Despite the decline observed today, the dollar continues to dominate the foreign exchange market.

At 14:00 (GMT) the decision of the Bank of Canada on the interest rate will be published. It is expected that the Bank of Canada will not change the current monetary policy. The rate will remain at the current level of 1.25%.

As Bank of Canada Deputy Governor Lawrence Schembri said earlier this month, the Bank of Canada "has to hedge itself because of the uncertainty surrounding NAFTA negotiations".

The strengthening US dollar and the uncertainty associated with the prolongation or amendment of the terms of the NAFTA agreement support the USD / CAD pair.

Nevertheless, investors will carefully study the text of the accompanying statement of the Bank of Canada. Rigid rhetoric of the accompanying statement and any hint of a rate hike in the coming months could cause a surge in volatility in the foreign exchange market and lead to the strengthening of the Canadian dollar.

If the rhetoric of the Bank of Canada's statement is soft, it will cause further weakening of the Canadian dollar.

)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

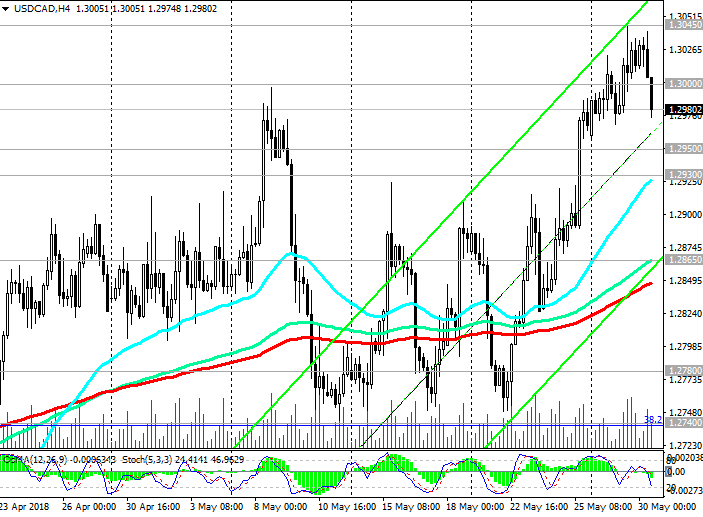

Support levels: 1.2950, 1.2930, 1.2900, 1.2865, 1.2780, 1.2740, 1.2600, 1.2550

Resistance levels: 1.3000, 1.3045, 1.3130, 1.3200, 1.3450

Trading Scenarios

Sell Stop 1.2960. Stop-Loss 1.3050. Take-Profit 1.2930, 1.2900, 1.2865, 1.2780, 1.2740, 1.2600, 1.2550

Buy Stop 1.3050. Stop-Loss 1.2960. Take-Profit 1.3100, 1.3130, 1.3200, 1.3300, 1.3450

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com