June 6, 2016

Bangkok, Thailand

In a bizarre story disclosed over the weekend, we learned that Belgium’s Princess Astrid was robbed by two assailants on a motorbike.

The thieves apparently approached her while she was sitting in traffic, smashed in her window, snatched the Royal Handbag, and sped off with over 2,000 euros in cash.

I have no doubt that was a harrowing experience for the princess, as it would be for anyone.

But as I researched a bit more, I learned that Belgium’s royal family is lavishly paid, particularly for a small country of just 11 million people.

King Philippe of Belgium receives more than 10 million euros per year. His father, the ‘retired’ king receives a pension of nearly 1 million euros annually.

Princess Astrid, the King’s sister, receives about 300,000 euros per year, in addition to usage rights of the royal properties.

In order to pay for this largesse, Belgium suffers some of the highest tax rates in the world, as high as 50% if you earn even a modest income.

In addition there’s 13% employee contributions to Social Security (plus employer contributions of 35%), and a Value-Added Tax of 21%.

Businesses in Belgium are subject to a 30% corporate tax rate, a 3% ‘crisis surcharge’, and my personal favorite, a 5% ‘fairness tax’.

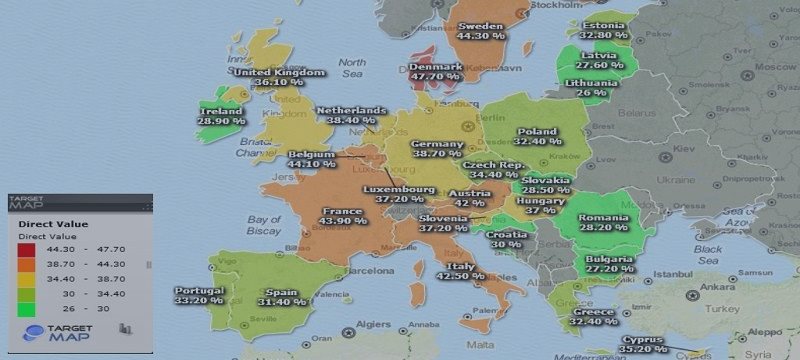

In total the Belgian government’s tax revenue eats up about 45% of GDP, which means that the government takes almost half of all economic output.

This is an astounding figure… though it’s less than other governments in Europe like France or Denmark.

Now, with due sympathy to the princess, I wonder if having 2,000 euros stolen by motorbike bandits is philosophically much different than having 50%+ of your income stolen by the government.

Both of these events can occur at gunpoint. Both carry severe penalties if you resist.

At least with the bandits it only happens once, or rarely, in a lifetime. With the government it happens every single day.

Every time you spend money. Every time you earn. Every time you invest. The government’s there taking its share.

US Supreme Court Justice Oliver Wendell Holmes Jr. once wrote that “Taxes are what we pay for civilized society.”

Of course, Holmes wrote that statement at a time when tax rates were about 3.5% (not a typo), so it’s completely taken out of context.

But the quote still serves as a rallying cry for Social Justice Warriors who want to take more of your paycheck.

The entire premise of income tax is that ‘your’ money isn’t really yours after all. It’s theirs.

They have first right to take as much as they like from your earnings, leaving you with whatever leftovers they choose.

Income tax is like a financial Primae Noctis. And yet governments always seem to want more.

I don’t get it. There are so many examples of low-tax countries that are thriving.

Even in Europe, for example, Estonia has a profits tax as little as 0%. And yet they consistently run a budget surplus.

Ireland has had a low-tax regime of just 12.5% on corporate profits for years, and they recently announced a new tax regime for certain companies as low as 6.25%.

Go figure, these low tax rates have attracted substantial investment (and jobs) from huge multinational companies, all of which has boosted the Irish economy.

So the Irish government essentially takes a small slice of a rapidly expanding corporate pie, as opposed to Belgium and France’s huge slice of a shrinking pie.

It’s not rocket science. If you create reasonable incentives, businesses will invest, the economy grows, and everyone wins.

But despite these obvious examples, bankrupt nations don’t want to do that. Instead they do the exact opposite, driving productive citizens and businesses away.

A few days ago, for instance, the European Commission released details of a tax directive that will create a pan-European tax system, complete with a brand new Tax ID number for all the good citizens of Europe.

The proposal also aims to increase taxes across the board if they feel that a member state (like Ireland) doesn’t charge enough tax.

According to the proposal, other European countries like Ireland and Estonia “distort competition by granting favourable tax arrangements.”

Apparently it’s not ‘fair’ that high-tax France and Belgium have to compete with low-tax Ireland and Estonia.

So rather than the bankrupt countries getting their act together to attract business, the solution is to penalize everyone and make the entire continent less attractive.

It’s genius!

The directive goes on to demand more onerous reporting, attack anyone who takes legal steps to reduce what they owe, and even threaten businesses with exit taxes if they try to leave Europe.

This really is like a return to the feudal system.

Until tomorrow,

Simon Black

Founder, SovereignMan.com