Global portfolio managers reduce the stake to the US 7-year low !!!

22 May 2015, 08:18

0

189

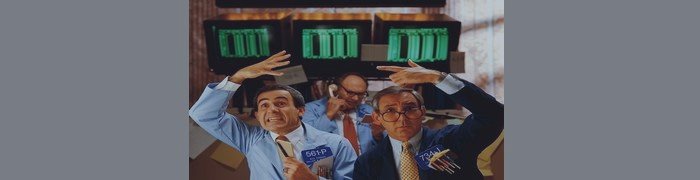

Fund managers have reduced the level of investment in US stocks to a minimum volume for the last 7 years, as shown by the report data Bank of America Merrill Lynch. This marked the highest level of cash in the portfolios of Governors - the 10-month record. This fact can even be seen as a signal of increased vigilance against US stocks. The level of cash in the portfolio began to increase from when FED announced its intention to raise. And when the dollar began to slip back a little, the volume of cash began to grow even more rapidly. The volume of shares was reduced by the total portfolio to 37% of total assets - is less than the investment in foreign assets and at least January 2008. At the same time S & P500 continues to grow. In 2014, an increase of 13%. Features of growth was evident on the technology industry, health and equity, consumer-oriented retail. It is interesting that now the maximum discharge papers is just for retailers. At the same time, investors buy shares cheapened the energy sector.