APAC Currency Corner – Will NFP Provide the Magic Bullet for the US Dollar?

APAC Currency Corner – Will NFP Provide the Magic Bullet for the US Dollar?

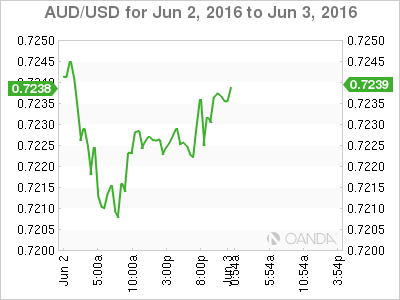

Aussie – trading heavy

Following up on Wednesday’s unexpectedly strong Q1 GDP report, Australia printed a much narrower-than-expected trade deficit of AUD1.6bn in April – the smallest in 14 months. But surprisingly the data failed to inspire. The Aussie dollar has had a difficult time this week capitalising on strong domestic data. Instead, traders continued to fade positive economic news knowing the RBA’s primary trigger is inflation. While recent data points to a positive outlook for the local economy it does not lead to any turnaround in inflation.

With inflation clearly in the RBA’s crosshairs, it is more likely that only a positive shift in inflation metrics will inspire traders to take the Aussie aggressively higher. Expect the Aussie to perform mixed over the short term on the back of broader US dollar movements, in particular with the market driven by event risk. However, we should not lose sight of the RBA current inflation-focused mandate. Overnight we saw the Aussie move lower on the back of broader US dollar strength after investors sold the Euro as ECB President Draghi failed to inspire.

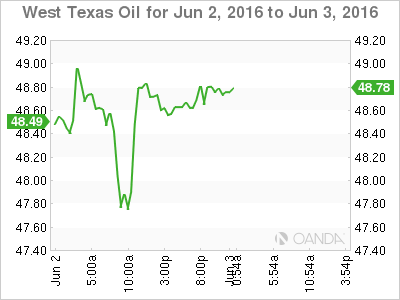

Oil – recovers after inventories drop

On the OPEC front, despite all the headlines, there is no production freeze and no subsequent talk of one. While WTI initially sold off below $48.00, it has since fully recovered after the Department of Energy inventory report, which indicated stocks fell by 1.37mn barrels, halted the slide and has offset the OPEC-induced price slump.

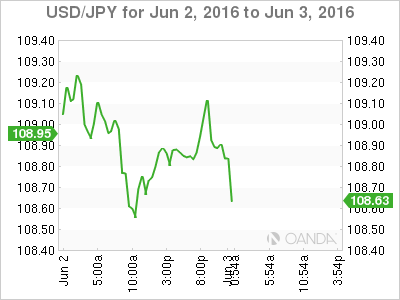

Yen – stimulus no-show

Equity markets have done moderately well overnight with the S&P500 closing up 0.3% after opening in the red only to reverse those losses. However, the Nikkei was the exception falling 2.3%. Investors expressed disappointment over the lack of urgency on the stimulus front after PM Abe indicated large-scale economic stimulus will likely come in the autumn. The market was expecting some type of coordinated effort between the BoJ and Tokyo. Traders are now pricing in diminishing expectations that the BoJ will ease this month, which continues to weigh negatively on USDJPY. We’re liable to hold consolidation patterns through to tonight’s all-important non-farm payrolls (NFP) data out of the U.S.

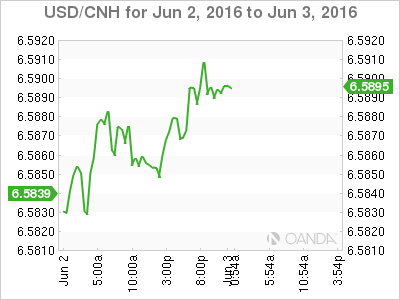

Yuan – still buying on dips

While the offshore USDCNH fell yesterday, the general buying-on-dips theme has not changed given the Fed rate hike seems to be a definite in either June or July. I expect a sleepy Friday session as traders sit tight ahead of tonight’s NFP. There are growing signs of more turbulence as according to data compiled by Bloomberg, mainland Chinese traders piled into Hong Kong equities at the fastest rate in more than one year. Mainland traders bought a net 21.9 million of shares listed on the city’s stock exchange in May. Risks are indeed increasing that capital outflows will accelerate to January’s, or even last August’s levels as the Yuan depreciation accelerates.

Today’s Fix 6.5793 vs 6.5688

Ringgit –through the ringer

The Ringgit continues to struggle after breaking the 4.1500 resistance level with broad based USD demand. While the prospects of a US rate hike weighs negatively, other factors are clearly at play. First, risk aversion on Brexit fears has likely sparked stock outflows. Second, ongoing concerns about 1MDB have begun to intensify again and are probably weighing on investor sentiment. Third, the prospect of accelerating Yuan depreciation given the imminent US rate hikes sets the stage for massive capital outflows in China which will likely spill over to local market causing broader selloffs regionally. Fourth, there may be some regional fallout from S&P’s decision not to upgrade Indonesia’s rating, which surprised some market participants. Finally, while unconfirmed, there was some chatter that yesterday’s pressure was due to real money funds increasing the size of their hedges against currency depreciation, to hedge their holdings of Malaysian government bonds.

Today at noon local time, trade balance data will be released for April. The expectation is for a MYR7.62bn surplus.