Daily Analysis of Major Pairs for May 24, 2016

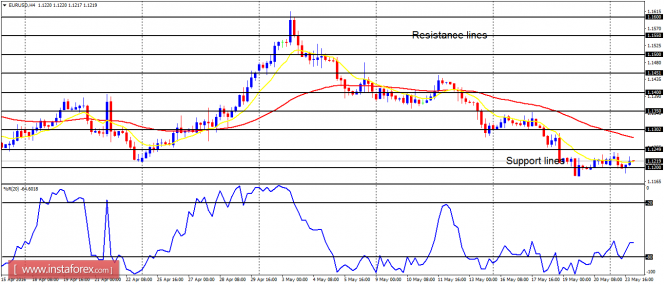

EUR/USD: On the EUR/USD pair, the support line at 1.1200, including another support line at 1.1150, might be breached this week. Nevertheless, it is possible that the EUR would rally – an event that could hamper the persistent bullishness in the market.

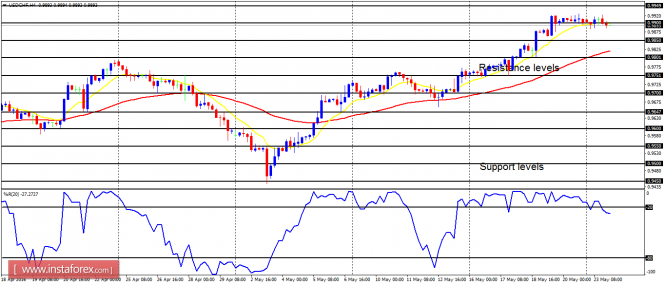

USD/CHF: The USD/CHF pair is still in a bullish mode, though the price simply went flat on Monday. The next target should be the resistance level at 1.0000, which means a parity area for the USD versus the CHF. However, there is one challenge bulls might face this week, and that is the anticipated rally in the CHF, which would make it difficult for bulls to push price far higher.

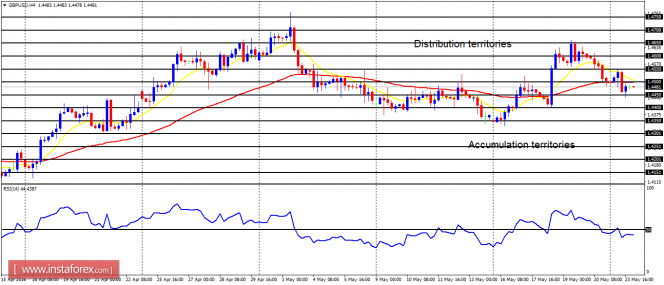

GBP/USD: The Cable did not make any significant movement on May 23, 2016, and the market remains on a neutral territory. There is a certain degree of ambiguity surrounding the Cable right now. Further southwards movement of 150 pips would result in a bearish signal. Further bullish movement of 150 pips would result in a bullish signal.

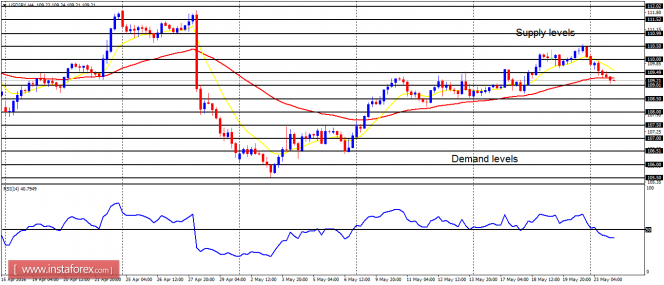

USD/JPY: Yesterday, this market got corrected by 120 pips. There are mixed signals on the chart: The EMA 11 is still above the EMA 56, while the RSI period 14 is below the level 50. It is better to stay out of the market until there would be a confirmed bias. A movement below the demand level at 108.50 would result in a bearish signal; whereas a movement above the supply level at 111.00 would reinforce the recent bullish outlook.

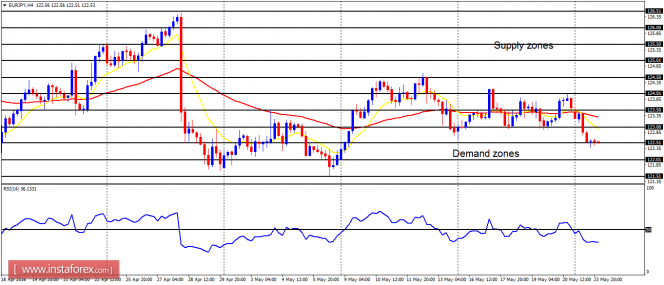

EUR/JPY: The EUR/JPY pair moved lower on Monday, out of the current equilibrium phase in the market. For this not appear like a false breakout, the price would need to go below the demand zone at 122.50. Otherwise, any rally from the current price location on the 4-hour chart would force the market back into the equilibrium phase.