FXWIREPRO: "Diagonal Credit Call Spreads" in XAU/USD to Serve Both Hedging and Speculating Objectives

FXWIREPRO: "Diagonal Credit Call Spreads" in XAU/USD to Serve Both Hedging and Speculating Objectives

The dovish comments contrasted with recent hawkish remarks by some Fed officials who indicated that the bank could act as soon as next month to raise interest rates.

Investors and economists dialled back their rate hike expectations in wake of Yellen’s dovish outlook, with traders of interest-rate futures now seeing no rate rise before November. A gradual path to higher rates is seen as less of a threat to gold prices than a swift series of increases. Prices of the yellow metal are up nearly 15% so far this year as investors seek safe havens in the face of mounting instability in other financial markets.

Technically, as you can observe monthly charts the yellow metal looks stronger in long term but short term trend remains in range (i.e. 1245/50-1225). After the trend has seen more than 61.8% retracement, it is now rejected below 50% fibo retracements and tight resistance at 1286.

Derivatives strategy for Gold's uncertainty:

Execution: Keeping the above both fundamental and technical factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the gold spot price is anticipated to drop moderately in the near term and spikes up in long term.

Trade expects that the underlying gold spot price would drop to ITM strikes on expiration and thereafter bounce back again.

Thereby, you are speculating the gold's struggle in short run by shorting, and hedge any dramatic upside risks in long term via longs in OTM strikes which is why we've used diagonal expiries.

Margin: Yes for ITM shorts.

Return: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

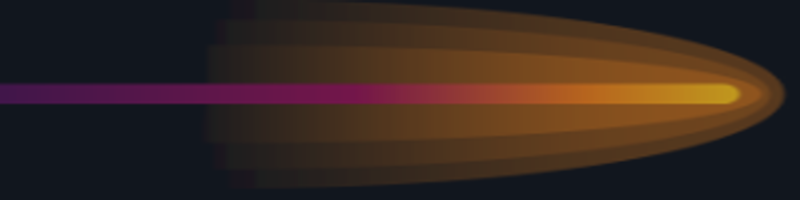

BEP: The break-even point lies between ITM and OTM strikes as shown in the diagram.

Risk: If the underlying spot gold price rises above the strike price of the higher strike call at the expiration date, then the bear call spread strategy suffers a maximum loss equals to the difference in strike price between the two options minus the original credit taken in when entering the position..

Effect of Volatility: No effect.

Please be noted that the expiries used in the diagram are exclussively for demonstration purpose, use appropriate diagonal tenors as stated above.

The material has been provided by InstaForex Company - www.instaforex.com