Crude Oil Prices Update: WTI & Brent Decline Sharply, Why?

Crude Oil Prices Update: WTI & Brent Decline Sharply, Why?

Crude Oil prices WTI and Brent fell sharply during the Asian session. Investors failed to prevent losses in crude oil price.

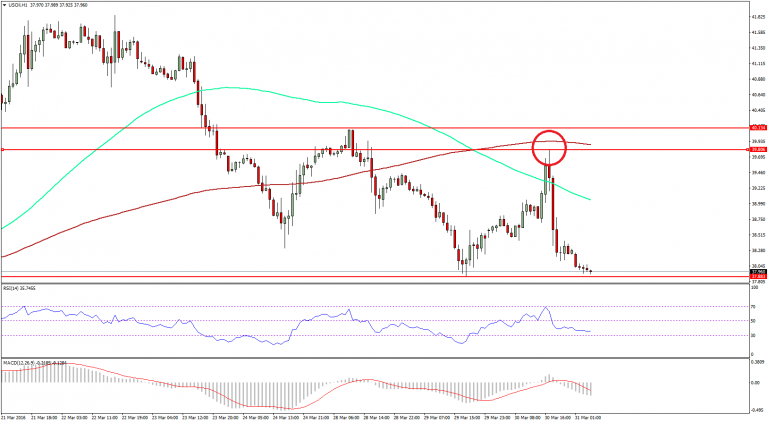

If we look at hourly chart, which we have been following for some time now, there was a sharp reaction near the $39.80 level in WTI Crude oil prices versus the US Dollar. The price also failed to close above the 100 and 200 hourly simple moving averages, and started to move down.

More Losses in Crude Oil Price?

Crude Oil prices are currently trading near a major support area of $37.90-95, which must hold, else there may be more losses in the near term.

Crude oil prices eased in Asia on Thursday as sentiment switched focus from a lower than expected stockpiles build in the U.S. to prospects for producers to at least freeze output. On the New York Mercantile Exchange, WTI crude for May delivery fell 0.70% to $38.05 a barrel.

Overnight, crude closed relatively flat on Wednesday on a volatile day of trading, paring sharp gains from a bullish U.S. weekly stockpile report after traders received indications that OPEC production increased moderately in March.

Brent Crude Oil Price Down

On the Intercontinental Exchange (ICE), Brent crude for June delivery wavered between $39.93 and $41.34, before closing at $40.10, up 0.25 or 0.60% on the trading day. Previously, North Brent Sea futures closed lower in three of four sessions, including a considerable sell-off last Wednesday when it tumbled more than 3%.

Brent futures are also up sharply since briefly dipping below $30 a barrel in mid-February. Crude futures soared as much as 4% on Wednesday after the U.S. Energy Information Administration reported a modest build of 2.3 million barrels for the week ending on March 25, slightly below expectations for gains of 3.3 million.

The reading also came in under forecasts from the American Petroleum Institute on Tuesday afternoon, which reported a build of 2.6 million. At 534.8 million barrels, U.S. crude stockpiles remain near historically-high levels. Despite the increase, total motor gasoline inventories declined by 2.5 million barrels last week while distillate fuel inventories fell by 1.1 million barrels. U.S. weekly production, meanwhile, declined by 16,000 barrels per day to 9.022 million bpd, falling to its lowest level since November, 2014.

Domestic weekly output in the U.S. has moved lower in 10 of the last 11 weeks. The gains, however, were short lived after a Reuters survey showed that OPEC production in March increased by 100,000 bpd to 32.47 million bpd, amid increases in Iran and Iraq. Iranian output, according to Reuters, has jumped by 230,000 bpd since December, as the Persian Gulf nation continues to ramp up production following the historic completion of its comprehensive nuclear deal with a host of Western Powers. In Iraq, an increase in exports in the southern region of the nation offset disruptions from a malfunctioning pipeline, which carries oil from the Kurdish in the northern portion of the country across the Turkish border.

For the month, output in Saudi Arabia was virtually flat as the oil kingdom continues to weigh whether to implement a proposed production freeze with Russia and two other OPEC members. Saudi production fell mildly to 10.18 million bpd in March, ahead of a highly-anticipated OPEC-Non OPEC summit in Doha next month. More than a dozen major producers are expected to attend the meeting in an effort to stabilize persistently low oil prices.

Crude oil has crashed more than 40% since November, 2014, when OPEC rattled global energy markets with a strategic decision to maintain its production ceiling above 30 million barrels per day. The tactic triggered a prolonged battle with U.S. shale producers for market share, creating an excessive glut of supply worldwide.

The material has been provided by FX News Call - Your Finance News Resources - www.fxnewscall.com