Intraday Technical Levels and Trading Recommendations for GBP/USD for March 23, 2016

Intraday Technical Levels and Trading Recommendations for GBP/USD for March 23, 2016

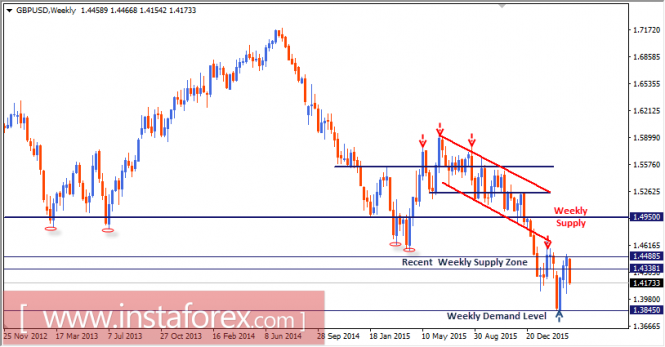

On January 21, after the GBP/USD pair moved below 1.4340, evident signs of bullish recovery were expressed around 1.4075. Hence, previous weekly candlesticks closed above 1.4340 again.

Bullish persistence above 1.4488 was mandatory to maintain enough bullish strength in the market. The first bullish target was seen at 1.4615 where the most recent bearish swing was initiated.

As previous weekly candlesticks maintained their bearish persistence below the depicted demand zone (below 1.4340), the next demand level was located at 1.3845 (historical bottom that goes back to March 2009).

As expected, an evident bullish recovery and a bullish engulfing weekly candlestick were expressed around 1.3850 (prominent weekly demand level). That is why, a valid buy entry was suggested near the same level.

Recently, the price zone of 1.4340-1.4488 constituted a significant supply zone to offer evident bearish rejection.

Temporary bearish rejection was manifested via the previous weekly candlestick until the price level of 1.4050 managed to push the pair again to the upside (note the lower tail of the previous weekly candlestick).

Note that bullish persistence above the price level of 1.4488 is needed to allow further bullish advancement towards 1.4620 to take place. Otherwise, a quick bearish movement towards 1.4050 should be expected.

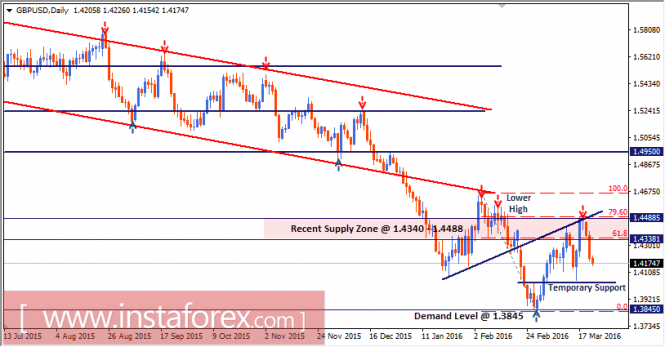

A recent lower high was achieved around the level of 1.4530. This applied extensive bearish pressure against the price level of 1.4340.

Hence, an extensive bearish breakout below 1.4340 was expressed on the daily chart (the GBP/USD pair looked oversold few weeks ago).

That is why, signs of bullish recovery and a profitable long entry were expected around 1.3850. A recent bullish swing was expressed towards the price levels around 1.4400.

On March 14, a recent bearish movement was initiated around 1.4350 (61.8% Fibonacci level). The nearest bearish target was located around 1.4050 where the current bullish swing was initiated.

This week, the price level of 1.4488 was being challenged. It corresponded to 79.6% Fibonacci level and the backside of the depicted uptrend line.

If bullish persistence above 1.4488 was maintained, a quick bullish movement towards 1.4650 should have been expected (low probability).

On the other hand, traders were advised to wait for a daily closure below 1.4350 (61.8% Fibonacci level) to SELL the GBP/USD pair. T/P levels should be located at 1.4150 and 1.4060. It is currently running in profits.

Conservative traders should look for bullish price action around the demand level of 1.4050 to BUY the pair. S/L should be located below 1.3950.

The material has been provided by InstaForex Company - www.instaforex.com