Before you start working on this strategy on H4 chart it is necessary to put two exponential moving averages. One with the period 2, the second with period 12. RSI with period of 14, OSMA or MACD settings 2,12,9. The trend direction is determined by the indicator VATrendCloud.

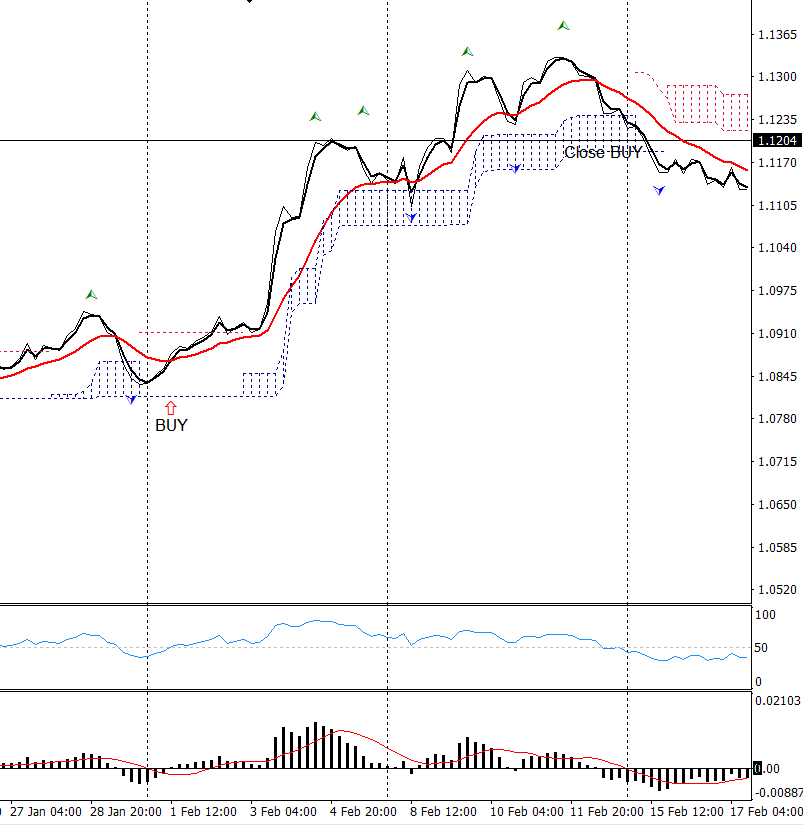

The deal to buy:

VATrendCloud shows an upward trend. The closing price of the last fully formed 4-hour candle above the two moving averages. In this case the RSI is above level 50, and OSMA crossed the zero level from the bottom up.

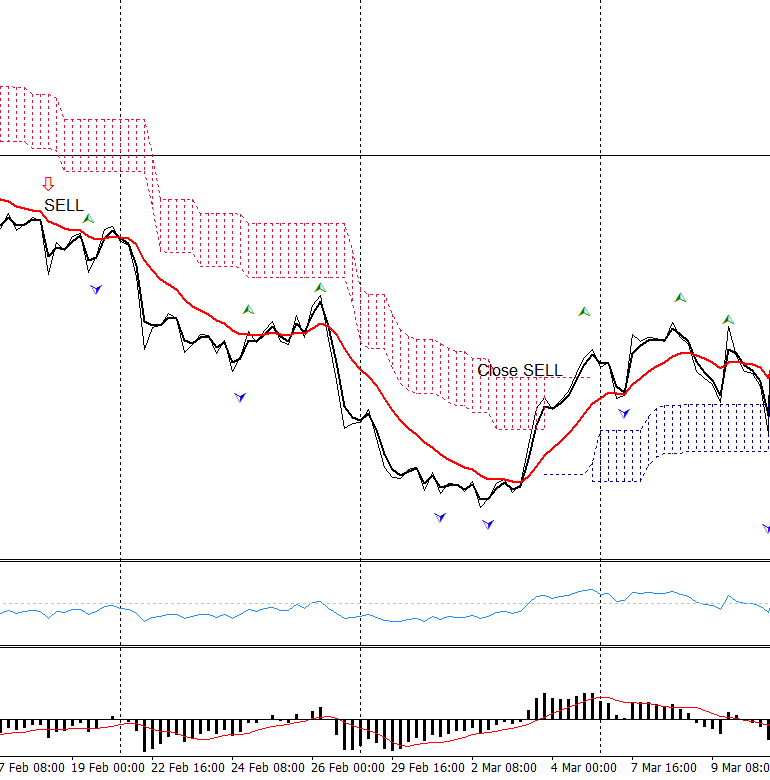

The deal to sell:

VATrendCloud shows a downward trend. The closing price of the last fully formed 4-hour candle below the two moving averages. When RSI is below level 50, and OSMA crossed the zero level from top to bottom.

Restriction of losses:

A stop loss set on the border of the indicator VATrendCloud, but not more than 150 points for 4-digit quotes or 1500 pips for 5 digit.

Taking profits:

Order take profit set in the amount of 2 maximum stop losses, that is, 300 points. Partial closing of a position when a certain profit of 150 points and a translation stop loss order for the remaining portion without loss .

The position is closed prematurely with the trend changes, which is determined by the indicator VATrendCloud.

Money management:

The risk per trade is set no more than 1-2% of your Deposit, subject to the stop loss size. For example: if you Deposit 1000$ and risk 2%, with the stop loss of 100 points, the volume of opened positions should not exceed 0.02 lots.

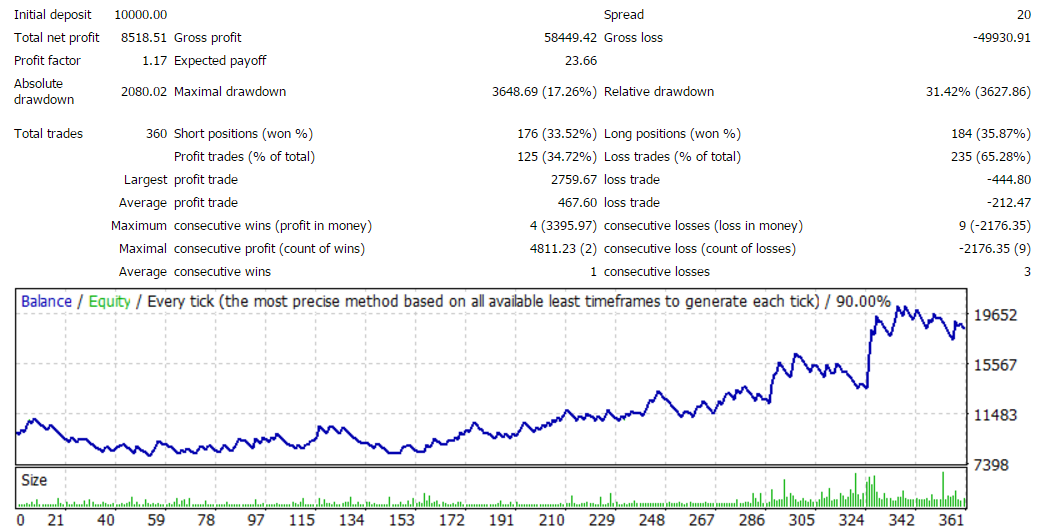

This strategy was created adviser VAH4AutoTrade. Although the adviser and has been developed in 2015, as can be seen from the test results, this strategy is still relevant and without parameter optimization. This strategy can also be tested using the manual strategy tester VAStrategyTester