01 Maret 2016 6:29 AM

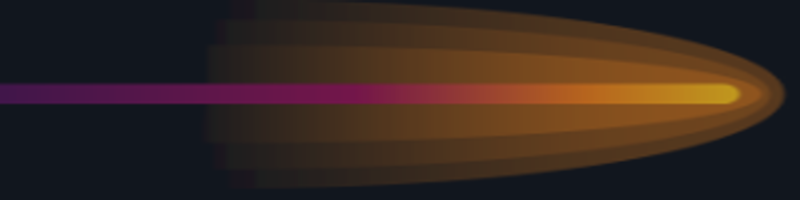

EUR/USD: The EUR/USD pair traded further south on Monday, making more conspicuous the bearish movement that started a few weeks ago. It is possible that bulls could succeed in pushing the price upwards this week or next; but right now, the bearishness in the market suggests that short trades are logical.

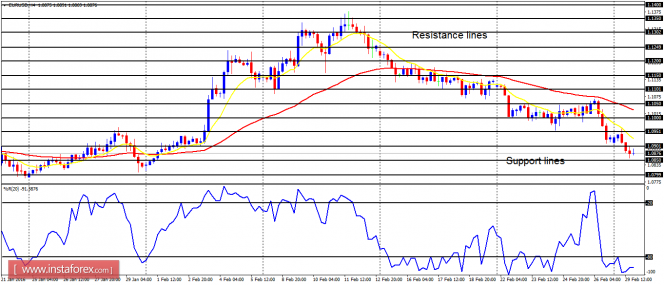

USD/CHF: This pair tried to move upward on Monday, but there was nothing significant in this. However, the EMA 11 is above the EMA 56, while the Williams' % Range period 20 is around the overbought region. There is a probability that the price would continue moving upwards, reaching the resistance levels at 1.0050 and 1.0100, for the resistance level at 1.0000 is now vulnerable.

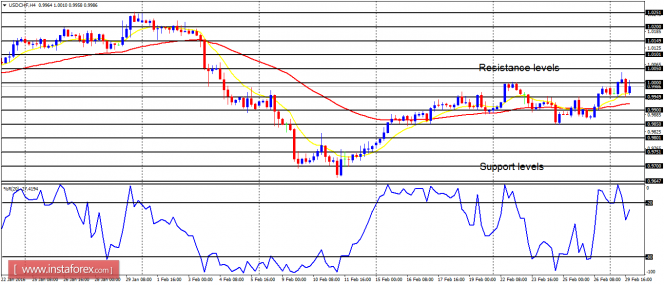

GBP/USD: The GBP/USD pair was volatile yesterday, with no clear movement. There is a Bearish Confirmation Pattern in the market and it is much more likely that the price would continue going down lower and lower. Generally, GBP pairs are bearish (as forecasted earlier) and they would remain under selling pressure until the end of March 2016.

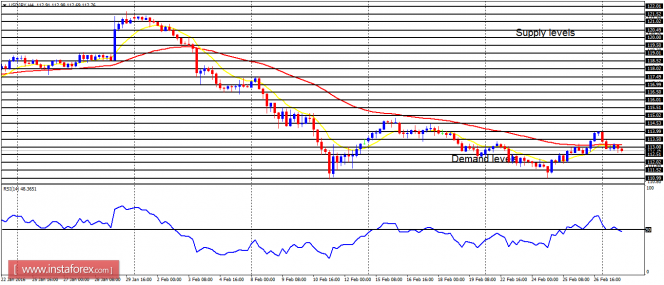

USD/JPY: This currency trading instrument did not make any significant movement on Monday (February 29, 2016). The market is not yet OK for swing trading until the price either goes above the supply level at 114.50 or below the demand level at 112.00. A movement to the upside is more likely.

EUR/JPY: The EUR/JPY pair traded lower on Monday, reinforcing the existing bearish bias. The demand zone at 122.50 has been tested and while it might be retested (and even breached to the downside), we would see sincere efforts from bulls, trying to push up the price. The bulls' effort might pay off before the end of the week.

The material has been provided by InstaForex Company - www.instaforex.com