Talking Points

- USD/JPY rallies violently into cyclical turn window

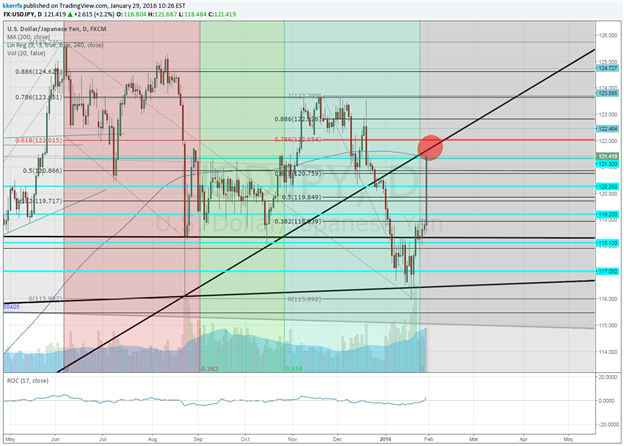

- 121.50 – 122.00 is critical resistance

USD/JPY: Shock & Awe

The Pi cycle interval from the June 2007 high (8.6 years) in USD/JPY suggested that we might get some fireworks around the BOJ meeting last night. This cyclical “heads up” certainly did not disappoint. As for what it means, going forward the price action over the next few days should prove pretty pivotal and have some important medium-term implications. Generally, into important turn windows like this I am looking for a move to materialize against the short-term trend within one to two days. In this case, that would mean some sort of clear failure against resistance by early next week.

The zone of key resistance looks to be 121.50 to just above 122.00, which we are testing now. This area marks a convergence of the 200-day moving average, the internal trendline connecting the October 2014 and August 20015 lows and the 61.8% retracement of the June - January decline (among other things). If we are going to get a reversal of importance in this turn window then I would probably expect to get it from somewhere around here. If the zone breaks convincingly, it is certainly possible that it could extend to 6th square root relationship of last week’s low or even the 78.6% retracements of the June - January decline (122.45 & 122.65) and then fail, but the odds go a lot lower in my book because of the negative technical and psychological damage that such aggressive strength in a short amount of time will have on the market.

The other possible scenario here is that the market does not turn around this window. This would have very obvious positive implications for USD/JPY and signal that the BOJ gambit has worked and that a much more important move higher is indeed underway. New highs after Tuesday would help confirm this.