Eliminating CFD Trading Mistakes

Every trader makes mistakes. However, many of the biggest and most typical mistakes made by CFD traders can be avoided or eliminated altogether! This article will cover how to combat these mistakes by discussing four trading mistakes and ultimately how to eliminate them. Let’s get started!

1. Have a Trading Plan

One of the biggest mistakes a trader can make is not having a trading plan. Nothing is worse than just trying to “wing it” by buying and selling on instinct. Before placing your first trade, know if you are trading market swings, retracements or breakouts. Then determine the lot size and stop placements before placing your first order.

To avoid “winging it”; execute a written trading plan using your determinants. While this may seem tedious, writing down a trading plan can hold you accountable to your actions. If you have ever wondered why you placed a trade, your trading plan should outline this in full detail. Also if a trade does not fit your trading plan, you can quickly avoid the setup while moving on to a new CFD.

2. Learn to Manage Risk Appropriately

Believe it or not, most traders don’t plan for a worst case scenario. This is a mistake because knowing where to exit a trade is just as, if not more important, than knowing where to enter a trade. To avoid losing money, set planned stops to automatically exit these worst case scenario trades as quickly as possible. This is particularly important when trading strong trending CFD’s such as gold and stock indices.

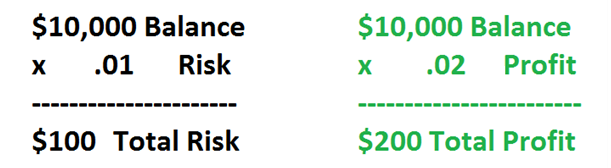

The best way to manage risk is to simply set a stop order on each trade. This way if the market turns against you, your trade will be exited at a specific point. Be sure to consider how much you are risking per trade. The easiest way to do this is to never risk more than 1% of your account balance on any one trade idea. This means that in a worst case scenario on a $10,000 balance, you will not take losses over $100 on any given trade idea. While following these steps will not help you avoid losses, taking steps to managing risk can help cut the impact to your balance when you do.

3. Avoid Cutting Winning Positions

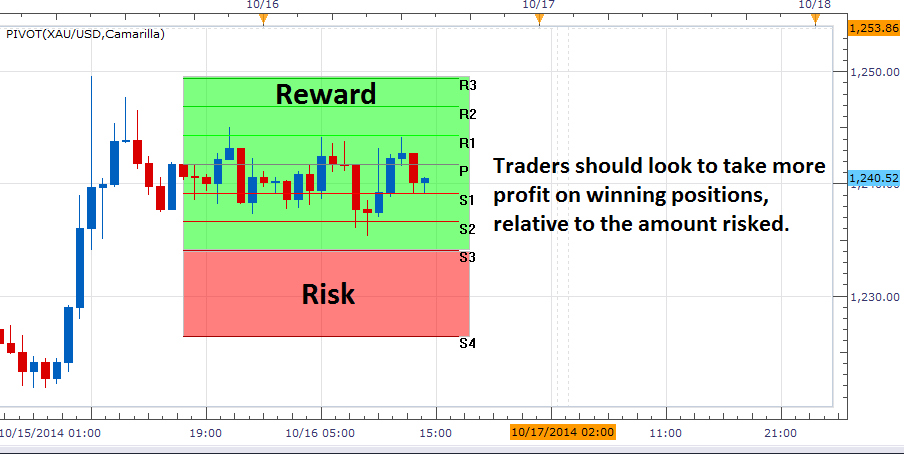

Just as traders tend to hold onto losing trades too long, they tend to cut their winning trades too soon. This becomes a problem when traders close multiple winners but the profits accrued don’t counter the losses sustained on one large loss. This mistake can be easily corrected by understanding Risk/Reward ratios and using them in your trading. So what exactly is a Risk/Reward ratio and how do we use it?

A Risk/Reward ratio compares the amount of profits we stand to make relative to our potential loss. For instance, if a trader uses a 1 to 2 Risk: Reward ratio, we are looking to make twice as much in profit relative to what we are risking if our trade is closed at a loss. A ratio can be modified by changing stop and limit positions; however, remember that the larger a profit target is relative to a potential loss, the less accurate we have to be in our trading to produce profitable results.

Gold 2 Hour Chart

4. Always Review Your Trading

A fourth costly mistake a trader can make is not reviewing their trading from time to time. Whether you are in the middle of a winning or losing streak, making an assessment is important. Traders should review their trading frequently, to see if their current strategy is working efficiently on their behalf or if it is hindering their ability to take profit. Many brokers offer a monthly report of your performance. Be sure to take advantage of this benefit!

Once you have your statement, take a look and find out whether you are following your trading plan, managing risk appropriately, or even using a strategy for current market conditions. This type of review can bring problems to the forefront that may have otherwise gone unnoticed or were simply ignored on a day to day basis. If you see any issues in your trading, you can make changes immediately to help eliminate any future trading mistakes!

Now that you are familiarized with common mistakes that CFD traders make along with methods to eliminate them, it’s time to remove these errors from your trading. To help practice you can register for a CFD demo account that many brokers offer for free.

NOTES:

- Traders can Eliminate Needless Mistakes with Proper Planning

- Always Have a Plan for Managing Risk and Taking Profit

- Review Your Statement to Adjust Your Trading to Conditions