Trading recommendations and Technical Analysis – HERE!

Last week before Christmas, oil prices rose amid data the U.S. Department of energy, under which oil reserves in the U.S. last week fell unexpectedly.

Despite a corrective increase of the previous week, the oil price failed to consolidate above $ 38.00 USD per barrel (Brent oil).

Today with the opening of the trading day the fall in oil prices is accompanied by a strengthening of the dollar against the commodity currencies, including the canadian dollar.

The anxiety of market participants regarding the prospects for the global economy and oversupply of oil on the world market caused oil prices to decline.

Thus, manufacturing activity in Japan in November decreased by approximately 1%. Japanese Nikkei Stock Average ended the trading session in Asia today, growth of just 0.6%, while Chinese indices were down. So, ChiNext closed with a decrease of 2.1%, Shenzhen Composite index - 2.2%, Shanghai Composite - on 2,6%.

Oil prices directly affect the quotes of the canadian dollar as the national currency of Canada retains the status of a commodity.

The canadian economy is experiencing considerable difficulties due to the sustained decline in oil prices. This, in turn, increases the risk of a reduction in the rate of growth of the economy.

In the beginning of the month, Bank of Canada Governor Stephen Poloz, said that it is possible to reduce the interest rate to a negative figure of 0.5%.

The monetary policy of the fed, aimed at gradual tightening, promotes the strengthening of the US dollar.

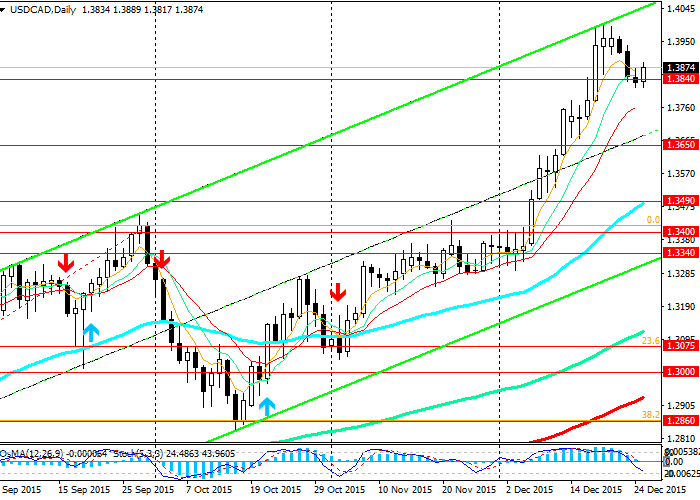

Thus, different orientation of monetary policies of Central banks in the U.S. and Canada, falling oil prices will contribute to further growth of the pair USD/CAD in the medium term.

See also review and trading recommendations for AUD/USD!