Top trades for 2016 by direction - The Royal Bank of Scotland

The Royal Bank of Scotland estimated the most interesting pairs to trade and their directions of the price movement in a medium-term situation and for long-term in 2016.

The EUR/USD price was estimated as a short in a medium-term and for 2016 as well: second pivot support level (S3 Pivot) at 0.9344 is still can be considered as the long term target for this pair.

EUR/JPY will become more bearish in medium-term: the price is located between 100 period SMA and 200 period SMA with the ranging market condition, and RBS is expecting for this pair to break 200 SMA support value for the reversal from the primary bullish to the bearish market condition. Anyway, RBS is not expecting for this pair to be in strong bearish in 2016.

Medium-term:

| Instrument | Direction |

|---|---|

| EUR/USD | Short |

| EUR/JPY | Short |

| EUR/GBP | Short |

| AUD/USD | Long |

Long-term 2016:

| Instrument | Direction |

|---|---|

| EUR/USD | Short |

| AUD/USD | Short |

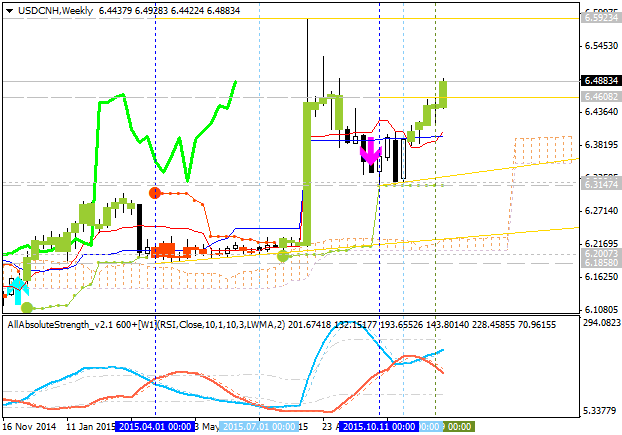

| USD/CNH | Long |

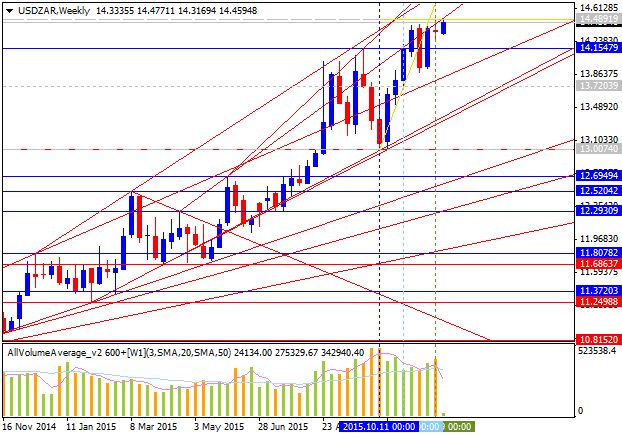

| USD/ZAR | Long |

One of the most profitable pair may be USD/ZAR which will be on strong bullish condition for whole the next year: 14.48 resistance level is likely to be broken soon for good possible breakout. So, you can open buy on this pair in January 2016 if your deposit is big enough for example.

The other interesting pair to trade in 2016 is USD/CNH. As the price movement of this pair is mostly related to fundamental news events so RBS is considering this 2016 movement as a strong bullish: the price is located above Ichimoku cloud for the primary bullish market condition breaking 6.46 resistance level with 6.59 level as the next bullish target.