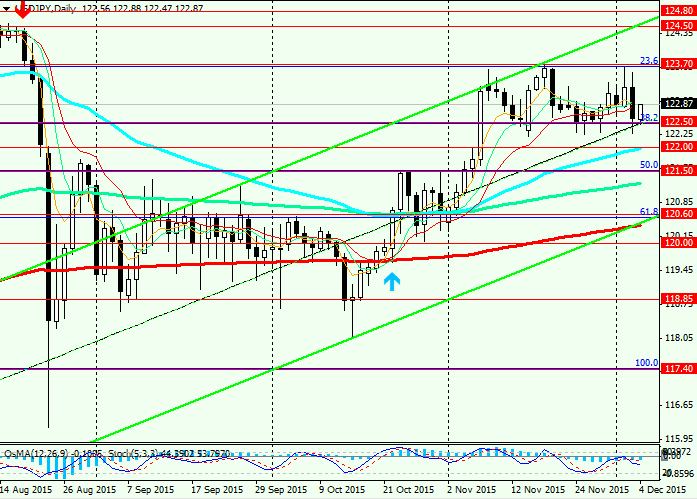

USD/JPY: Bank of Japan and the FED have different priorities. Trading recommendations

Trading recommendations and Technical Analysis – HERE!

The consumer confidence index in November rose (42,6 against the forecast of 41.8 and 41.5 in the previous month).

Wages in Japan in October in annual terms grew by 0.7% (vs. forecast for 0.4% and 0.4% in the previous month). The bonuses accounted for the main part of wage growth (+23.9% in annual terms). And, it is likely that real wages in Japan may be reduced next month. In the end, wages are not growing fast enough to create sufficient pressure on inflation remaining close to zero.

GDP in Japan declined for the second consecutive quarter, indicating a slowdown and recession in the economy.

Despite the fact that yen finds support from investors as the status of safe-haven currencies

the USD/JPY pair support pending the possibility of easing monetary policy in Japan at the next meeting of the Central Bank on 28 and 29 January.

Also USD/JPY will tend to increase amid expectations of higher interest rates in the U.S. the fed meeting on December 15-16.

About the possibility of this increase and subsequent gradual tightening of monetary policy in the U.S. has repeatedly said key fed officials.

Softer than expected markets yesterday's ECB's decision on QE in the Eurozone are now expanding opportunities and room for manoeuvre of the fed and the Bank of Japan.

The decline of the Euro to parity with the dollar is about to resume. Yesterday's drop in the dollar, especially in pairs with eurovalue, was caused mainly by the closing of speculative short Euro positions.

With the opening of today's trading day, and especially European session dollar regains its position.

The attention of market participants switched to today's Non-Farm PayRolls for November, which will be released at 13:30 (GMT). Today's data on labour market situation in the U.S. will be key to the FED's decision on interest rates at its meeting on 15-16 December.

The importance of these data, it is difficult to overestimate. The volatility and dynamics of the dollar pairs, including USD/JPY, at the time the news release will be the strongest.

If the forecast (assuming the increase in new jobs of 200,000) are not met, it is expected the weakening of the dollar in the market. The strength of this attenuation will depend on the magnitude of the deviation from the forecast.

See also review and trading recommendations for GBP/USD!