Trading recommendations and Technical Analysis – HERE!

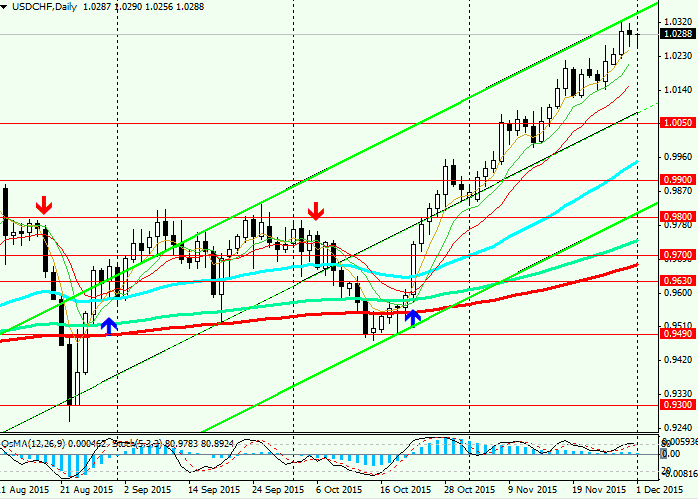

After a sharp weakening of the Swiss franc last Friday, due to possible interference NB of sales Swiss franc against the Euro and dollar, the trading week started with a decline of the pair USD/CHF. Trading in the pair are aligned. In the Asian session today the pair was also decreased, however, with the opening of the European session after economic data published by Switzerland in November, the pair USD/CHF rose. The business activity index (SVME) in Switzerland in November was 49.7 (versus the forecast of 50.5), retail trade fell in November (by 0.8% against +0.4% in forecast).

Earlier released data on the state's GDP showed zero growth in Q3, as compared to the same period of the previous year increased by only 0.8%, indicating economy of Switzerland. The rise of the Swiss franc as safe-haven currencies continued to have a negative impact on exports. Also on the state of the Swiss economy was influenced by the Swiss NB decision in January to cancel the lower limit for the EUR/JPY that has made Swiss goods more expensive for the Eurozone. Swiss exports in Q3 declined by 0.9% compared to the same period of the previous year.

It is not excluded that NB of Switzerland has to resume intervention in the currency market by selling francs to weaken the franc to other currencies and maintain export-oriented economy.

This will put pressure on the franc and to support the pair USD/CHF in the medium term.

The next meeting of national library of Switzerland on monetary policy is scheduled for December 10.

If the SNB will resort to easing monetary policy in the country, and the fed will raise interest rates at its meeting on 15-16 December, the USD/CHF pair will get a double impetus to further growth.

From the news today waiting for the US data coming out of the block, news on USA, aired at 13:55 (GMT) to 21:00, including the index of business activity in the manufacturing sector (ISM) in November (the forecast of 50.3 against 50.1 in the previous month).

Volatility in USD pairs will be increased at this time that need to be considered when making trading decisions.

See also review and trading recommendations for GBP/USD!