Trading recommendations

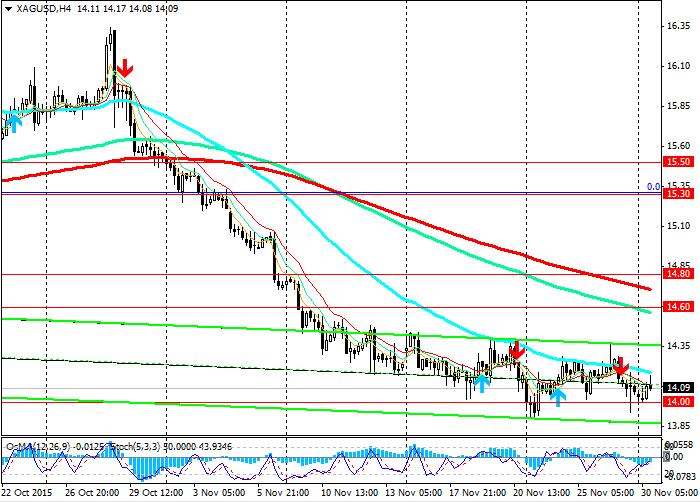

Sell by-market. Stop-Loss 14.35. Take-Profit 14.00 13.80, 13.50

Alternative long positions will become relevant after the price fixing above the level of 14.60 with the objectives 15.30, 15.50.

Indicators and Levels

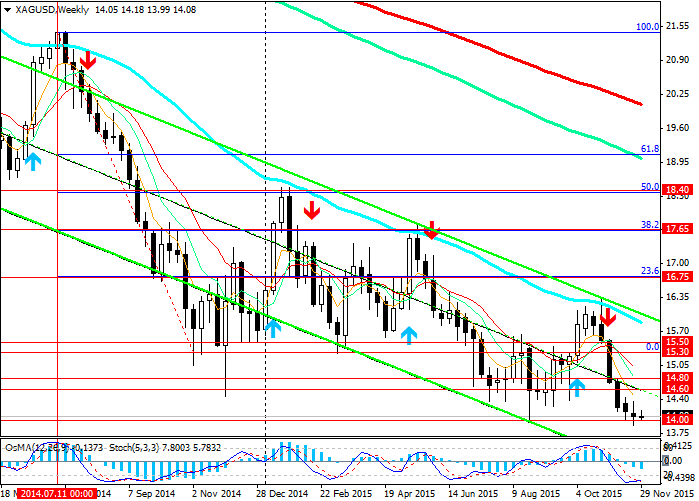

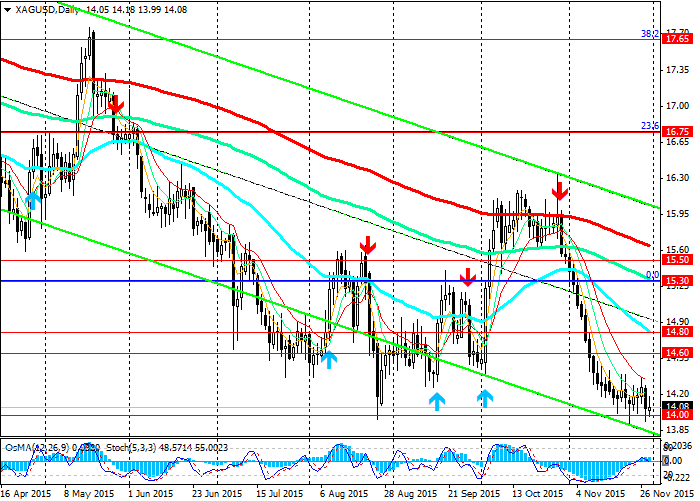

On the weekly chart the OsMA and Stochastic continue to recommend SELL. However, on 4-hour and daily charts the indicators takes place on a long position.

Possible correction to the level of 14.60 (EMA144, EMA200 on 4-hour chart). It is also possible flat near current levels until the fed meeting on December 15-16.

In anticipation of the fed's decision the pair XAG/USD has stabilized near the mark of $ 14.00 per ounce, at the level of the July lows.

A pair XAG/USD moves down in the channel on the daily chart with the lower border below the level of 13.85 and on the weekly chart the lower line below the 13.50 level. Key support - 14.00 (the lows of the year), the breakdown of which will accelerate the decline.

Support levels: 14.00, 13.80, 13.50

Resistance levels: 14.35, 14.60, 14.80, 15.30

Overview and dynamics

Since the beginning of the trading day the dollar shows mixed performance for precious metals. If at the beginning of the Asian session it rallied to gold, then to silver slightly weakened.

The dollar also strengthened against the currencies – the franc and the yen.

By the end of COMEX trading on Friday quotes of the February gold futures dropped 13.50 USD or 1.3%. The price of March futures for silver declined by 12.7 per cent, the January futures for platinum – 8,10 dollar, March futures for palladium – 1.35 USD.

The strengthening of the US dollar amid expectations of higher interest rates in the U.S. continued to put pressure on the willingness of investors to purchase precious metals.

In late October, the leaders of the fed signaled that at the meeting of 15-16 December a decision will be made on the rates, but it will depend on whether the recovered American economy sufficiently for such a step. When interest rates begin to rise, the precious metals will drop even more, because they do not bring dividends to the investors, and their storage costs.

The attention of market participants focused on Friday, when at 13:30 (GMT) will be published data on the state of the labor market in the U.S. in November, which will be a crucial one for decision on interest rates at the fed meeting.

Today, according to futures on interest rates, the possibility of higher interest rates in the US in December is estimated at 78% (a month ago this probability was estimated at 52%). The WSJ dollar index is at 13-year highs.