Trading recommendations and Technical Analysis – HERE!

On the eve of Thanksgiving in the U.S. on Thursday and subsequent weekend, many market participants reduce their long positions on US dollar.

According to yesterday's data, the business activity index (PMI) in the manufacturing sector in the U.S. according to Markit, which is an important indicator of the state of the U.S. economy overall, in November fell to a 2-year low 52,6 (with a reading of 54.1 in October against the forecast of 53.9). However, the US dollar strengthened yesterday to commodity currencies, including the canadian dollar, given the continuing decline in world prices for commodities due to global economic slowdown.

With the opening of the Asian trading session the pair USD/CAD goes down. Support the canadian dollar have a growing oil prices. Saudi Arabia signaled yesterday a readiness to work with the leading oil producing countries to stabilize oil prices, which are in a strong downtrend due to oversupply of oil on the world market.

However, the effect of the statement of the state news Agency of Saudi Arabia may not be long lasting. Even if OPEC agree to cut production, U.S. shale oil producers can quickly ramp up production. Its share of the oil market doesn't want to give none of the major players.

Weekly data from the U.S. Department of energy, which will be released on Wednesday are expected to show a decrease in oil reserves in the United States. This may temporarily support the oil price, and hence the canadian dollar.

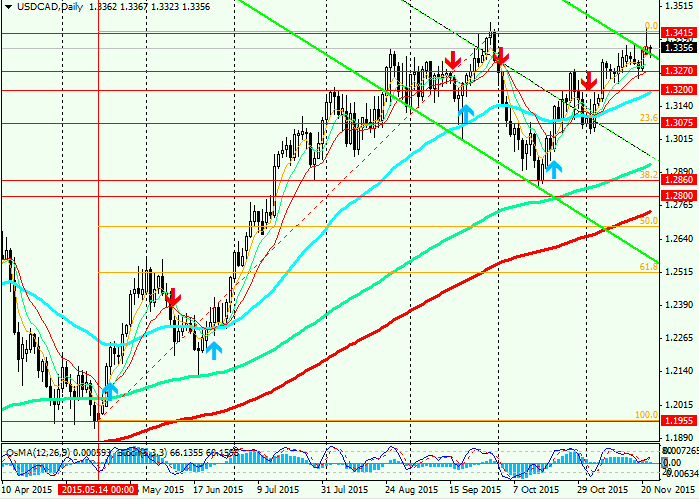

However, in the medium term the pair USD/CAD will rise due to the strengthening of the U.S. dollar in the market and low oil prices and soft credit-the monetary policy of the Bank of Canada.

In October, the Bank of Canada left its key interest rate unchanged at 0.5%, as soon as the next Bank of Canada meeting will be held on 2 December.

In addition to dense block of news from USA today waiting at 15:30 (GMT) quarterly review of the Bank of Canada report on the canadian economy and Central Bank policy.

See also review and trading recommendations for EUR/USD!