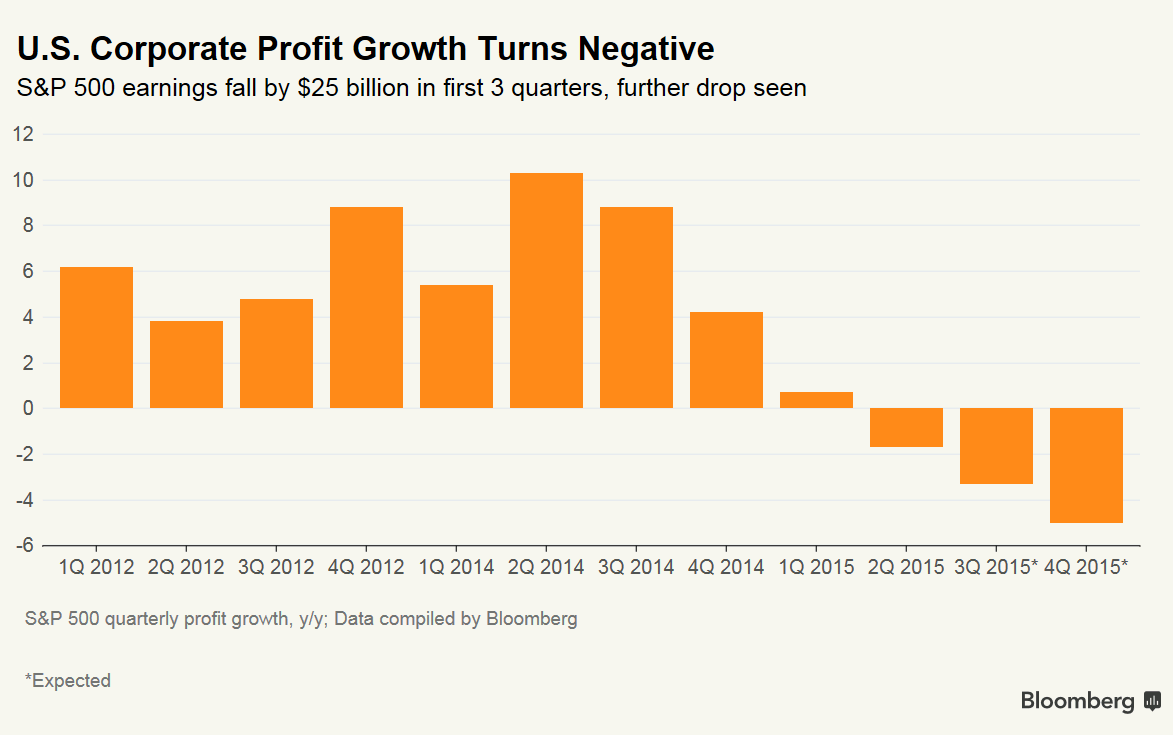

S&P 500 profits lose $25bn in first three quarters of this year. Thanks, oil & dollar!

Profits from S&P 500 firms have fallen by about $25 billion in the first three quarters of 2015, and a further fall is expected before the year-end, says Bloomberg, as energy companies struggle with lower oil prices and a steep rally in the dollar hits exporters.

To date, about 96% of S&P 500 companies have reported 3Q results. Their aggregate net income from continuing operations for the first three quarters is $804 billion, from $828 billion for the first three quarters last year, according to data generated by Bloomberg.

Over the same period last year, the aggregate revenue for S&P 500 companies has fallen by $287 billion.

On a share-weighted basis, S&P 500 profits dropped 3.3% on year in the third quarter, making this earnings season the worst since 2009, and marking a second quarter in a row of negative earnings growth.

Plunging oil prices hurt the energy sector the most. Earnings in the sector have lost 57% in the third quarter year-over-year.

Analysts say the negative trend is to linger in the fourth quarter, with a 5% drop is expected in S&P 500 profits in the fourth quarter.

Societe Generale quantitative analysis research team agreed that plummeting oil has undermined the energy sector, but the strong dollar also weighed:

"The

question for us is not are we in a U.S. profit recession, but how bad

is it likely to get and what are the implications for the wider U.S.

economy, and with that massive consensus long on the U.S. dollar," they

wrote in a note last week.

Shifts in U.S. import prices usually lead profitability by about 12 months, and without a reversal in the dollar's rally, a U.S. industrial profit recession looks "baked in the cake" for 2016, they said.

Analysts at Citi consider that the negative influence on earnings from lower energy prices shouldn't continue next year as oil prices are set to stabilize.

"This is not likely to happen again, unless you think crude is going to $25 a barrel," a Citi analyst said, adding that there is a boost to consumption which has not revealed itself yet.