AUD/USD: under pressure 2 factors. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

Yesterday's meeting minutes of Committee FRS on operations in the open market ("FOMC minutes") have raised doubts among market participants in raising US interest rates in December. Although the protocols did not say anything new, some of the heads of the Central Bank consider it premature. If the increase in the number of jobs and the inflation backdrop will not change for the worse, the increase in December is still possible, however, further monetary tightening will be slow.

AUD/USD rebounded from monthly lows near the 0.7000 level last week when a fairly strong jobs data and lower unemployment in October in Australia, have forced market participants to question the expectation of higher interest rates in the country at the next meeting of the RBA on December 1.

The unemployment rate in October fell to 5.9% versus 6.2% in the previous month. The number of jobs in October increased significantly with almost full employment and exceeded the forecasts of economists almost four times (58 600 15 000 against the forecast).

Nevertheless, coming from China negative data regarding the economic recovery of this country, putting pressure on the Australian currency.

China, as the closest trading partner of Australia and the Australian buyer of raw materials, is showing clear signs of economic slowdown and easing inflation and domestic demand, despite the efforts made by the authorities of the country.

Today from China today received a message that the people's Bank of China cut interest rates within an ongoing credit programs: 7-day rate to 3.25%, "overnight" rate - up to 2.75%.

According to previous data, the producer price index of China declined for the year by 5.9%. Together with the reduction of exports in October (down 6.9%) strongly reduced the import (-18,8%) in China, including Australian goods.

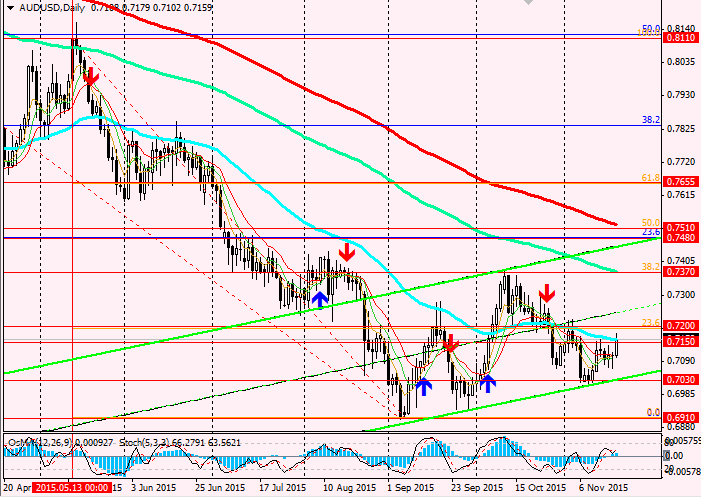

Despite the strong employment data in Australia, AUD/USD continues to remain under pressure due to the slowdown of the Chinese economy, almost zero inflation in Australia, the decline in world commodity prices, slowing economic growth and reducing investment in the economy of the country.

As repeatedly stated by the RBA Governor, Glenn Stevens, the country needs an accommodative monetary policy.

So the intrigue regarding lowering the interest rate in Australia on 1 December remains in force. This will keep AUD/USD from further growth. Two powerful fundamental factors – the fed's commitment to a gradual, albeit very slow, the tightening of monetary policy in the U.S. and the need for loose monetary policy in Australia – will exert downward pressure on AUD/USD in the medium term.

See also review and trading recommendations for Brent!