AUD / USD: the pair will continue there? Trading recommendations and Overview

A little later came yesterday from China next portion of negativity. The volume of new loans in China in October fell sharply, reaching 513.6 billion yuan against 1.05 trillion yuan in September, indicating weak demand and a large number of defaults of loans granted earlier. To speed up the Chinese economy seems to require further measures of fiscal policy easing and economic conditions.

China, as a close trading partner of Australia and the Australian buyer of raw materials, is showing clear signs of an economic slowdown and weakening inflation and domestic demand, in spite of the efforts made by the authorities of the country.

According to published data earlier in the week, the index of producer prices fell for the year by 5.9%. Together with the decline in exports in October (-6.9%) greatly reduced imports (-18.8%) in China, including Australian goods.

According to RBA, the national currency should be cheaper because of orientation of the country's economy on exports, primarily raw materials for the Chinese market. As repeatedly stated by the head of the RBA Glenn Stevens, the country needs a soft monetary policy.

Given the slowdown in the Chinese economy as the most important trade and economic partner of Australia, almost zero inflation in the country, the decline in global commodity prices, slowing economic growth and the reduction of investment in the economy, the RBA is very close to a decision to reduce interest rates in Australia. The next meeting of the RBA on the issue will be held December 1.

From the news today are waiting for data from the US, go to 15:30 (GMT + 2) (data on retail sales for October. The forecast of 0.3% against 0.1% in September) and at 17:00, when the index of consumer published confidence from the Reuters / Michigan in November (forecast 91.5 against 90 in October).

The US dollar may strengthen the market in the profit and confirming predictions.

Trading recommendations

Sell Stop 0.7110. Stop Loss 0.7150. Take-Profit 0.7030, 0.6960, 0.6910

Buy Stop 0.7170. Stop-Loss 0.7140. Take-Profit 0.7210, 0.7300, 0.7380

Indicators and Levels

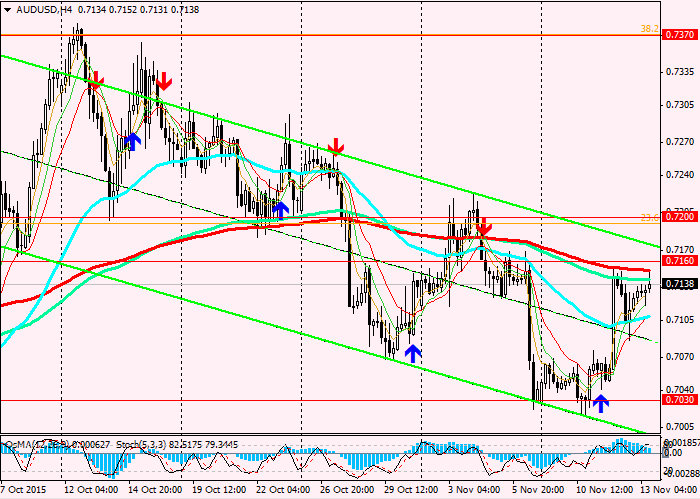

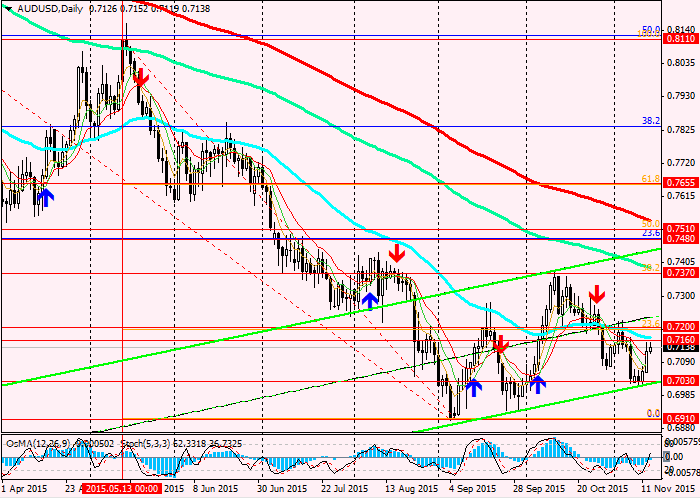

AUD / USD is quite well yesterday on positive news from Australia has adjusted to the resistance level 0.7150 (EMA50 on the daily chart, as well as the top line of the descending channel and EMA200 the 4-hour chart).

Despite the relatively strong decline in the Australian dollar against the US dollar for the year (1,700 points or 20%), with AUD / USD continues to move towards the 2008 lows at around 0.6000.

On the 4-hour chart indicators OsMA and Stochastic are starting to signal short positions.

The pair is close to the resistance level 0.7150 (EMA200). The pair rebounded from the bottom line of the ascending correctional channel on the daily chart near the level of 0.7030. If the breakdown level of 0.7150 will not take place, the AUD / USD pair risks to return to the downward trend. Then the closest targets will be the levels of 0.7030, 0.7000 (the lower line of the descending channel on 4-hour chart), 0.6950 and 06910 (lows of September and year).

Break of the 0.7150 level could send the pair to 0.7390 marks (EMA144 on the daily chart, and highs in August, October 2015), 0.7500 (Fibonacci correctional level of 23.6%, EMA200 and the top line of the rising channel on the daily chart).

Break the lower limit of the upward correction of the channel on the daily chart at 0.7030 will send the pair to the 0.6985 level and the lows of September and the year 0.6910.

Support levels: 0.7100, 0.7030, 0.6950, 0.6910

Resistance levels: 0.7150, 0.7190, 0.7325, 0.7390, 0.7500