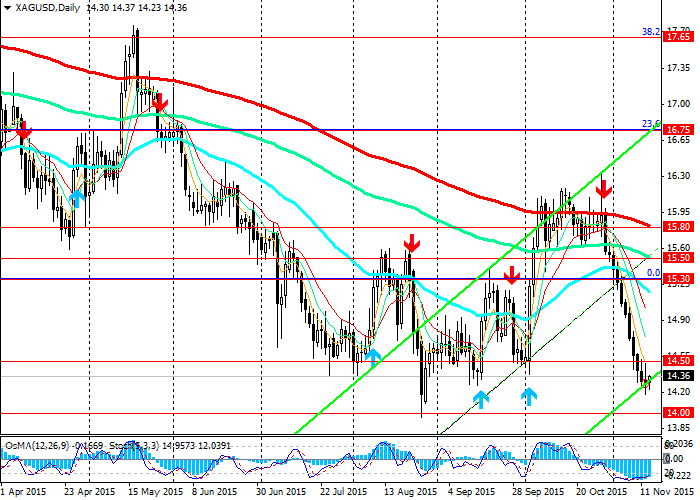

XAG/USD: precious metals fell heavily in November. Trading recommendations

Trading recommendations and Technical Analysis – HERE!

In yesterday's speech by the Fed did not hear anything new regarding the possibility of raising interest rates in the United States at the next Fed meeting on 15-16 December.

If Janet Yellen did not relate to the topic of rising interest rates, the other members of the Federal Reserve (the head of the regional federal banks, William Dudley, Charles Evans, Jeffrey Lacker) and have not clarified the final opinion on the matter.

It's late at night (European time), vice chairman of the Fed, Stanley Fischer at a conference in Washington, the Fed said that the strengthening of the US dollar hurts exports and economic growth. The results of the December Fed meeting depends on an assessment of progress in achieving the objectives of the Federal Reserve. The US economy is resistant to the growth of the US dollar and a rate hike in December, "may be justified."

Strong NFP data in the US in October, released last week (271 000 new jobs against 180 000 forecast 000 and 137 in September), increase the likelihood of interest rate rises in the United States.

Meanwhile, US stocks fell on Thursday: S & P 500 - by 1,4%, Dow Jones Industrial Average - on 1,4%, Nasdaq Composite - 1.2%. Also falling prices for oil and precious metals.

Gold prices were down 0.4% to 1080.80 dollars an ounce, the lowest level in more than five years due to expectations about higher interest rates in the United States in December.

Other precious metals also fell: December futures for palladium - by 3.1%, the January futures for platinum - by 0.7%. December silver futures fell 3.8 cents. The price of silver is near 6-year lows.

In the context of rising interest rates the attractiveness of precious metals for investment is reduced because the cost of borrowing and storage increases. The price of silver will find support, as this metal is used in industry as a raw material. However, pressure on the pair XAG / USD in the medium term towards its decline will continue.

Today at 19:30 in favor of FOMC members Meister and probably also touch topics of rate hikes. A little earlier will come the big news for the United States.

At 15:30 (GMT + 2) in the United States published data

on retail sales for October (forecast 0.3% vs. 0.1% in September). At 17:00 the

consumer confidence index published by Reuters / Michigan in November. Upon

confirmation of the forecast (91.5 against 90 in October), the dollar

strengthened on the market and in a pair XAG / USD.

See also review and trading recommendations for the pair GBP/USD!