Trading recommendations and Technical Analysis

As reported today, the International Energy Agency (IEA), by 2020 shale oil in the US will recover and rise to a new peak of 5 million barrels a day.

However, oil production in the US has decreased in recent months, due to the low profitability in the oil price below $ 50 per barrel.

Rising oil prices holding back as the OPEC policies aimed at increasing the level of oil production in order to keep its market share, and the expectation of entering the global market of Iranian oil, which has about 20% of world oil reserves.

Despite the positive expectations of growth of oil consumption in the world in the coming years, the supply of oil in the world market continues to exceed demand.

According to the Secretary General of the OPEC oil-producing countries outside the cartel, refused the offer of cooperation to limit global supply.

At the next meeting in Vienna on 4 December, representatives of the member countries of OPEC and other oil-producing countries are likely to try again to negotiate on the issue of reducing oil production. However, hope for such an outcome remains a bit in view of the differences between the participants.

However, in the longer term, according to the IEA, the price will be supported by the increasing demand for oil from China and India, which provides nearly a quarter of the growth in world oil demand. And the price of oil could reach $ 80 per barrel in 2020.

Meanwhile, December futures for Brent crude traded near the level of 47.19 dollars per barrel. Pressure on prices due to oversupply persists and expectations of interest rate rises in the US in December, and the price tends to levels below 47.00 dollars to the lows of the year near the mark of 42.50 dollars per barrel mark Brent.

From news of the week is necessary to pay attention to Thursday, when the 16:00 (GMT) published data from the US Department of Energy to change in US oil inventories last week. With an increase in stocks of oil price decrease.

Trading recommendations

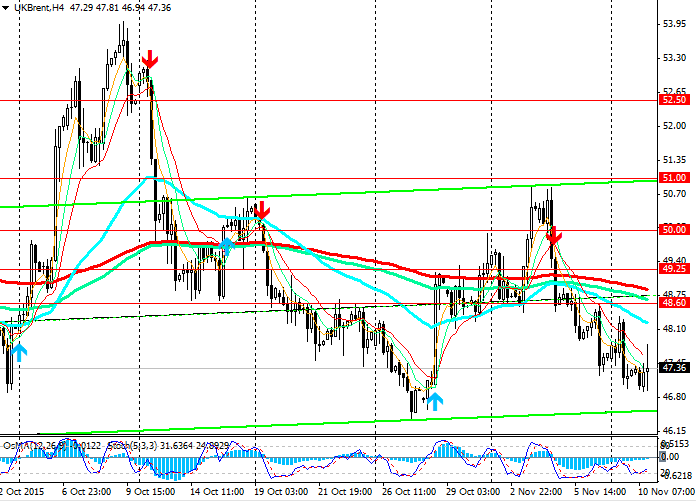

Sell Stop 46.80. Stop-Loss 47.20. Take-Profit 46.00, 44.50, 42.50

Buy Stop 48.10. Stop-Loss 47.80. Take-Profit 49.00, 49.50

Technical analysis

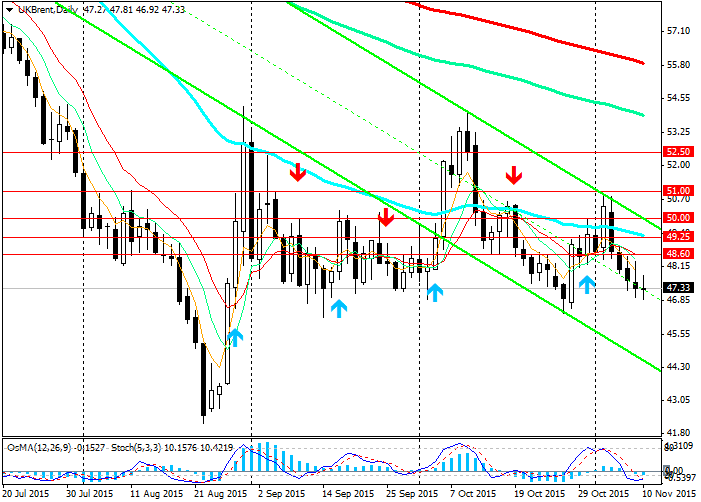

Mostly basic downward trend. The price of Brent crude moves within a corridor declining on the daily chart with the lower boundary near the level of 44.50 and currently is on the bottom line of the corridor 54.00 - 47.00 dollars a barrel.

OsMA and Stochastic indicators on the 4-hour, daily and weekly charts recommend short positions.

Only a return above the levels of 49.00 (EMA200 the 4-hourly chart), 49.50 (EMA50 on the daily chart), 50.00 (the upper limit of the downward channel) could return the price of an upward trend, but not above the level of 54.00 (EMA144 on the daily chart and the upper limit of the range of 54.00 - 47.00).

Break of 47.00 will send the price level consistent support levels 46.00, 44.50 (lower line of the descending channel on the daily chart) and possibly further to the lows of the year near the mark of 42.50.