Moody's warning, Portugal developments, Chinese inflation data - all weigh on Europe stocks today

Shares in Europe edged down on Tuesday due to a number of weakening factors, beginning with inflation in China and ending with moods in Portugal.

German DAX dipped 0.51%, while London's FTSE 100 declined 0.7%.

Spanish IBEX was last down 0.43%, while France's CAC lost 0.69%.

Inflation in China slowed again in October, adding to signs of an economic downturn. The consumer price index rose just 1.3% in October from a year earlier, slowing from 1.6% in September. Economists had expected a 1.5% increase.

The producer price index fell 5.9% from a year earlier, matching Septembers decline and slightly worse than forecasts of a 5.8% drop.

The weak data added to concerns over slackening demand and growing deflationary pressures in the world's second largest economy.

In Portugal, the parliament votes on the new centre-right government’s legislative program today. Socialist MPs, who won a majority of seats last month, are expected to bring the administration crashing down. That would allow them to start rolling back some of the country’s tough spending cuts and tax rises.

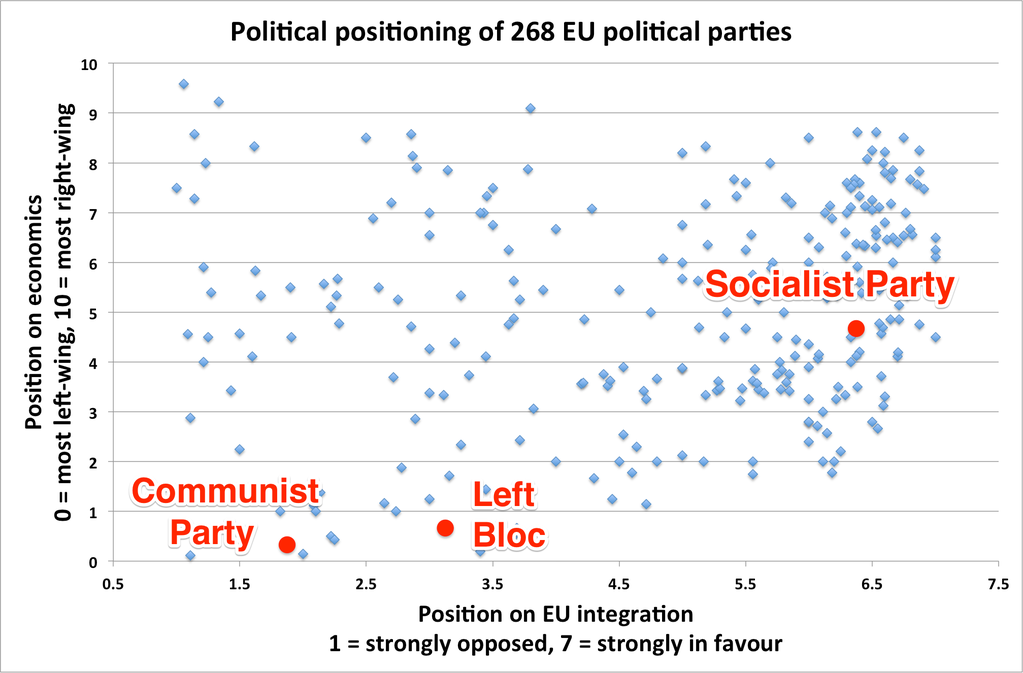

A group of left-wing parties, who hold a majority of seats between them, could form a new government. Yesterday, prime minister Pedro Passos Coelho claimed that an alliance of socialist, communist and other leftist parties would be “ruinous for Portugal”.

Political analysts are broadly convinced that a coalition of left-wing parties will dethrone Passos Coelho. However, that alliance could be strained, as they cover a range of views:

Source: Mike Bird, Business Insider

In Greece, the cabinet met this morning, to discuss their next step after failing to receive new bailout funds from their euro partners last night.

Prime minister Alexis Tsipras must now decide whether to agree tougher new rules on defaulting mortgages and other bad loans.

Meanwhile, ratings agency Moody's issued a warning earlier Tuesday. The body said that deepening problems in emerging markets such as China will hamper global growth over the next two years, and could even threaten the stability of the global economy.