Trading recommendations and Technical Analysis – HERE!

After entering the information about what OPEC does not want to reduce the volume of oil production, the oil price falls. OPEC Secretary General Abdalla Salem El-Badri on Tuesday accused the oil-producing countries outside the cartel, in the rejection of cooperation with OPEC.

However, according to experts of OPEC, is expected next year the growth in demand for oil, as noted on Monday, OPEC Secretary General.

On Sunday, it was reported that in October of this year, oil imports to China rose by 9.4% compared to the same period last year. However, despite the encouraging data from China and the reduction in the number of drilling rigs in the United States, oil prices will remain under pressure due to excess supply over demand of oil in the world market in the medium term.

Waiting for a rate hike in the US in December, which intensified after the release of strong data on US labor market on Friday, will also have a negative impact on oil prices and put pressure on them.

The Canadian dollar is largely retains the status of commodity currencies, and Canada's economy depends on the revenues of export earnings from oil sales. The country is a net exporter of oil, and its oil sector is an essential part of Canada's economy. This correlation pair USD / CAD and oil prices close to 92%.

Earlier in October, the Bank of Canada left its key interest rate unchanged at 0.5%, and noted that to sustain growth, inflation and the economy the Bank of Canada will be inclined to hold soft monetary policy. According to the Bank's inflation will remain below the target level of 2% before 2017, and the forecast of economic growth in Canada for 2016, 2017 lowered. Full utilization of the Canadian economy is now possible not earlier than in 2017.

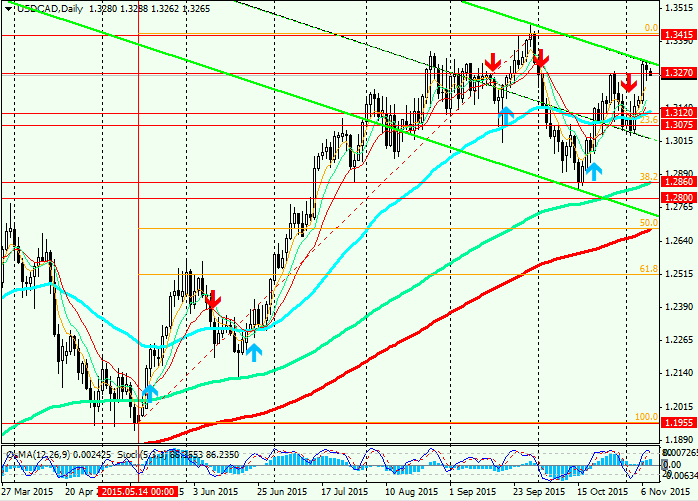

Thus, three powerful factors (excess of supply over demand in the world oil market and reduced the price of oil in connection with this, the expectation of higher interest rates in the US, as well as the commitment of the Bank of Canada's loose monetary policy in the country) will support the USD / CAD is in the medium term. The trend will continue to strengthen couples and reduction pair USD / CAD should be considered so far only in the correction to the uptrend. Long positions still look promising.

From news of the week regarding the pair USD / CAD

should pay attention to Thursday (16:00 (GMT) - data from the US Department of

Energy to change in US oil inventories last week) and Friday (13:30 (GMT) - the

level of retail sales in the US in October)

See also review and trading recommendations for the pair USD/JPY!