NZD / USD: interest rate reduction is not excluded. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

On Sunday came the negative data on the trade balance of China. Together with the decline in exports in October (-6.9%) greatly reduced imports (-18.8%). The slowdown of the Chinese economy, as the largest trading partner of New Zealand, a decrease of Chinese imports from New Zealand, significantly reduce the inflow of export revenues to the state budget.

Increased concerns over the situation in the housing market countries, low world prices for dairy products, the largest exporter of which is New Zealand, slowing GDP growth, as well as another increase in the trade deficit may force the RBNZ to go for another interest rate cut in New Zealand at its next on 9 December.

Tuesday at 22:00 (GMT + 2) RB New Zealand publishes a report on financial stability, and a little later the head of the RBNZ, Graeme Wheeler will assess the current economic situation in New Zealand and possibly outline further prospects of monetary policy in the country. After a sharp decline last week, especially on Friday, when it was published surpassed market expectations and forecast report NFPR in the US in October (forecast at 271 000 180 000), now with the opening of the Asian trading session the pair NZD / USD was able to adjust and to grow by about 20 points.

However, the outlook remains negative. In addition to the strong data on NFPR in October, according to revised data, in September and August in the United States was created 12 000 jobs more than previously reported, and in the period from August to October, the average number of jobs outside agriculture in the United States grew by 187 000 per month. The US unemployment rate in October was also down (5.0% vs. 5.1% forecast and 5.1% last month), reaching the lowest level since April 2008. After the publication of strong data on employment in October, the probability of a rate hike in the US in December, has become much stronger. As early as last Wednesday the head of the US Federal Reserve Janet Yellen said that the increase in interest rates in December, "very likely."

While previously 28 October RBNZ did not change the interest rate in the country, the head of the RBNZ Graeme Wheeler has repeatedly said he did not rule out the possibility of further interest rate cuts in New Zealand, as well as return to the country's budget deficit in 2016.

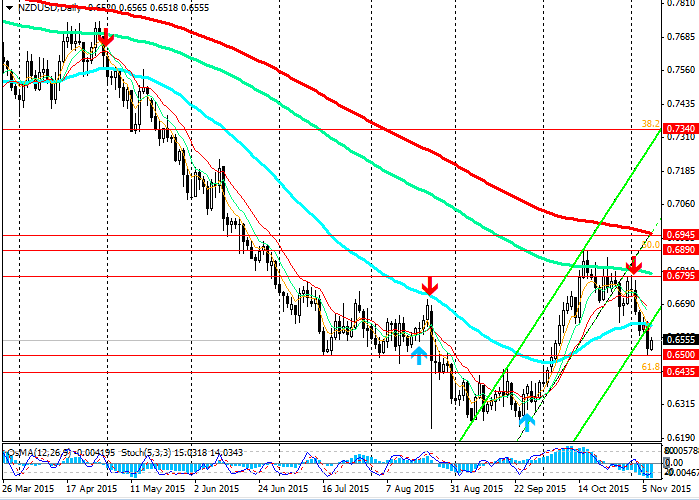

The expectations of a possible reduction in interest rates in New Zealand, and the tightening of monetary policy of the US Federal Reserve in December, the pair NZD / USD is exposed to the risk of further decline.

See also review and trading recommendations for the pair GBP/USD!