The dollar gathered momentum and dragged EUR/USD

to fresh lows sub-1.0950 despite the latest string of US data came in the soft

side.

US factory orders fell 1.0% in September against a decrease of 0.9%

expected, while prior months’ were revised down to -2.1% from -1.9%. Separated

data showed IBD/TIPP economic optimism index fell to 45.5 vs. 47.5 estimate

while on the flip side, US ISM NY index for October rose to 65.8. versus 44.5

the previous month.

The dollar shrugged off negative readings and

extended gains versus the shared currency, with EUR/USD hitting a low of 1.0935

before finding support. At time of writing, the pair is trading at 1.0950, still

0.58% down on the day.

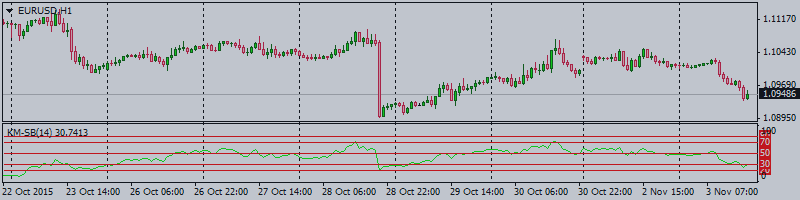

EUR/USD levels to watch

In

terms of technical levels, immediate supports could be found at 1.0896 (Oct 28

low) and 1.0847 (Aug monthly low) ahead of 1.0800 (psychological level). On the

flip side, resistances line up at 1.1071 (Oct 30 high), 1.1095 (Oct 28 high) and

then 1.1107 (200-day SMA).