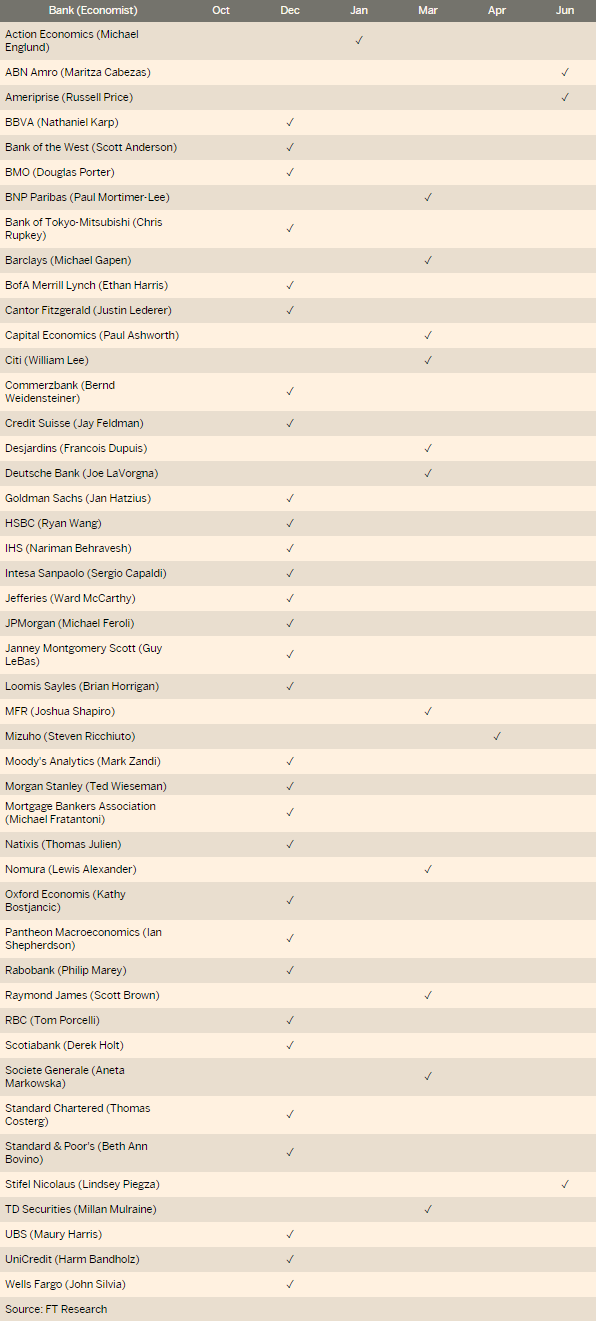

Almost two-thirds of economists still expect Fed rate hike this year - FT Research

Nearly two-thirds of analysts surveyed by the Financial Times expect the U.S. central bank to increase interest rates before the end of 2015, despite weakening economic data that several banks have warned have put the Fed’s inflation goal on a slippery ground.

Despite a decline in the U.S. labor market, 65 per cent of the 46

economists from leading banks in the U.S., Europe and Asia said the Fed would elevate the Federal funds rate at its

December meeting.

The view runs counter to market expectations, where observers have scaled down the chance of tighter monetary policy before March 2016, and to recent remarks from top policy makers at the Federal Reserve, who have cautioned against an early tightening.

- More than half of the economists polled said the

Fed risked a policy error this year, though being split on

whether the mistake was lifting rates too soon or too late.

- Several argued that sluggish economic data — including disappointing retail sales, industrial production and regional manufacturing reports — and muted inflation highlighted the necessity to wait.

- None of the strategists said they awaited the Fed

to increase rates following its next meeting on October 28, a conference not

currently accompanied by a press briefing.

- More than 85 per cent said that the central bank would have elevated rates twice by the time it concludes its June meeting in 2016.

- More than a dozen economists said communication was either “moderately” or “very unclear”, as markets were jittery due to division at the central bank.

Trigger-shy Fed officials frustrated the marketplace and fired volatility in September, after deciding to keep rates near the lowest level since the financial crisis. Many market players said the decision to wait was a sign of fears the global economy was slowing.

Before the September meeting, more than nine-in-10 economists polled by the FT awaited the central bank would have shifted policy off its current near-zero interest rate by the end of the year, says FT's Eric Platt.

Since that time, top Fed policymakers have admitted that the strong dollar and swings in financial markets have acted as the equivalent of a rate increase, cautioning that a further tightening by the central bank could hamper the U.S. rebound.

Lower commodity prices, put under pressure by dim conditions in China and across the emerging markets, have also dampened confidence that inflation will come back to the Fed’s stated target of 2 per cent.

Interest rate futures have broadly priced out the probability of a rate increase before 2016, with odds first climbing above 50 per cent for the Fed’s March meeting, says federal funds futures analysed by CME Group.