Fundamental Weekly Forecasts for US Dollar, GBPUSD, USDJPY, AUDUSD, and GOLD

US Dollar - "This past week, we have seen the ECB warn of weaker inflation forecasts, the market bolster its expectations of a QQE upgrade for the BoJ in 2015 and the outlook for the BoE’s hike move the end of 2016. FX is a relative field. When the Dollar’s alternatives are looking at a neutral or outright dovish bias it reminds us that in the land of the blind, the one-eyed man in king."

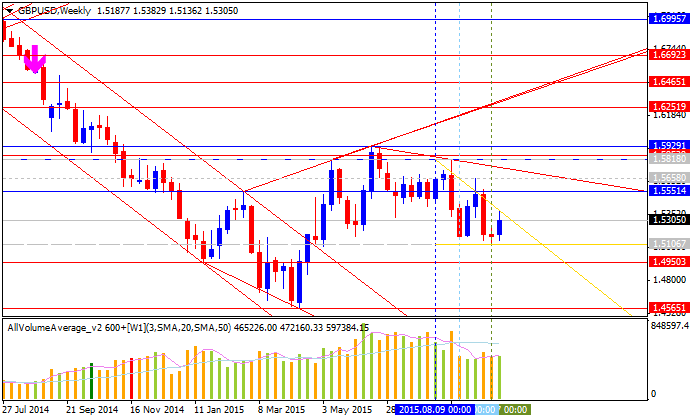

GBPUSD - "The forecast for the Pound remains neutral for now, until a more defined fundamental direction can develop as the world grapples with slowing growth and a lackluster economy a full six years after the financial collapse. The UK and the BoE are one of the few spots other than the US that might be looking at higher rates in the not-too-distant future; but should matters change and should growth continue slowing, those expectations for higher rates will likely diminish and these currencies (both GBP and USD) could face massive weakness as rate-hike bets price out of the market."

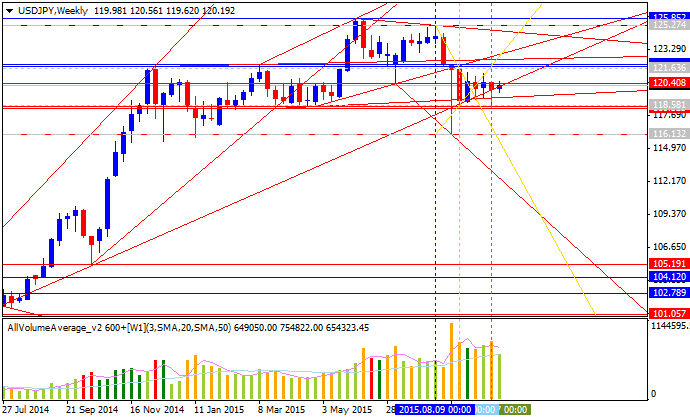

USDJPY - "A slew of positive U.S. data prints paired with a batch of hawkish Fed rhetoric may boost the appeal of the greenback and threaten the range-bound price action in USD/JPY as it boost interest rate expectations. Meanwhile, the developments coming out of Japan may encourage bets for a more BoJ easing as the central bank keeps the door open to further insulate the economy."

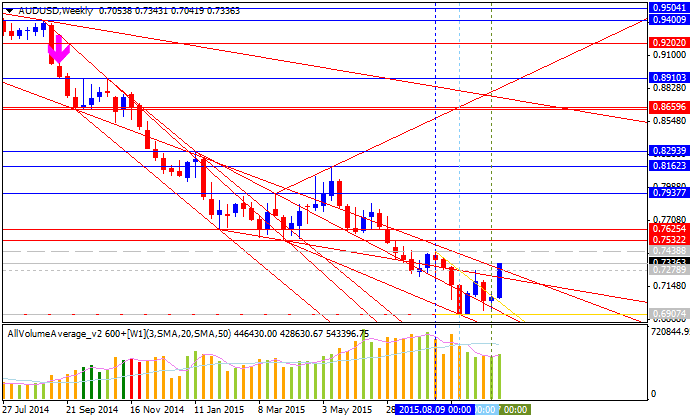

AUDUSD - "US price growth readings have firmed relative to analysts’ expectations since mid-year. If this trend continues and puts the core year-on-year CPI growth rate above 1.8 percent for the first time in 14 months, traders may begin to entertain calls for a 2015 rate hike championed by most Fed officials in recent commentary. This could trigger risk aversion, weighing on the sentiment-linked Australian unit."

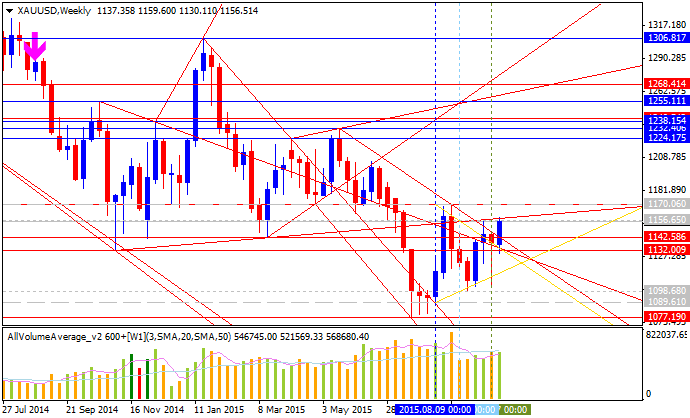

GOLD - "From a technical standpoint gold is set to close the week above the upper median-line parallel of a formation dating back to the 2014 high with Friday’s rally holding just below confluence resistance into 1159/62. This region is defined by the 61.8% extension off the yearly lows, the 100% extension off the September low & the Jun swing low. Note that the daily relative strength index is also testing a resistance trigger off the August high and a breach here alongside a rally through 1162 keeps the topside in focus targeting 1177 there the 200-day moving average & the median-line off the early low converge. Key resistance is seen high into 1197/98.The trade remains constructive near-term while above immediate support at the 10/2 reversal-day close / Friday’s low at 1138, with a break back below the monthly open at 1114 needed to shift the focus back to the short-side."