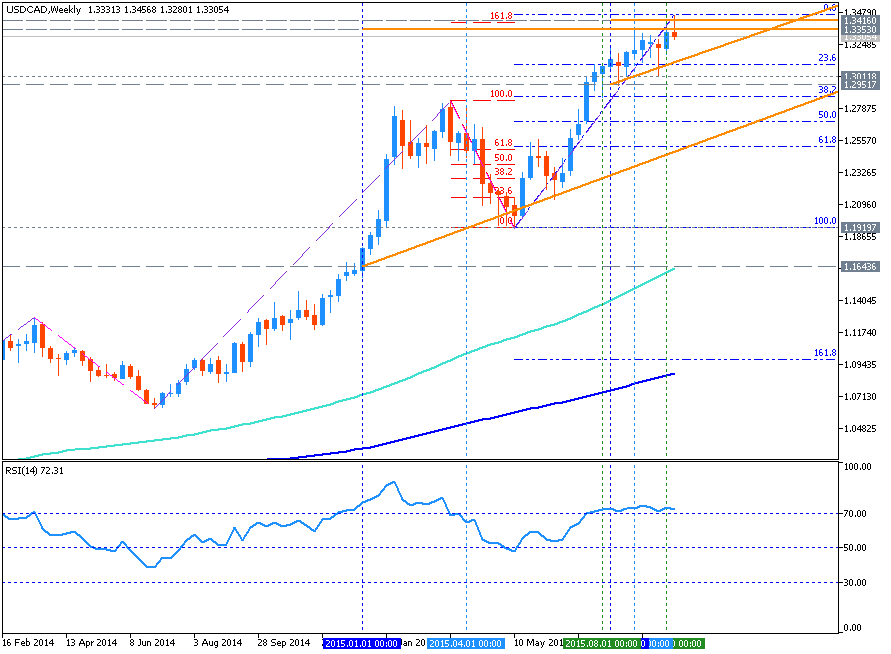

W1 price is above 200 period SMA (200 SMA) and 100 period SMA (100 SMA) for the primary bullish market condition:

- The price is trying to break Fibo resistance level at 1.3457 from below to above for the bullish trend to be continuing;

- Ascending triangle pattern was formed by the price with 1.3416 resistance to be crossed to above for good possible breakout in the near future;

- "For now, I will be flat on USDCAD awaiting a test for 1.3315. A break of those levels, along with the corresponding confirmation in USOil and US dollar would cause me to scale into a short trade around 1.3300 targeting 1.2950. If 1.2950 is hit, stops would be taken to breakeven as a larger reversal could be underway. If 1.3315 holds as support, a ‘buy the dip’ mentality should continue to serve you well as the trend isn’t ready to retire."

"Major resistance points to the upside being hit warning that Canadian strength could appear soon however, the level at 1.3465 is still higher favoring upside for now. When combined with analysis on USDollar, it is important to watch how the dollar index reacts to the March 13, 2015 high. If resistance is respected on both USDCAD and USDollar then a retest of the recent low around 1.3010/1.2950 zone is likely ahead. Additionally, a break below these levels could indicate a larger top has been put in on the late September move."

Trend:

- W1 - bullish