The Doomsayer's Guide to the Fed, Rates and What Could Go Wrong.

16 September 2015, 20:03

0

235

- Some Fed watchers caution that financial specialists are still not well arranged.

- Where the following ``crack'' rises is hard to foresee, BMO says.

It's the most firmly dismembered and exceptionally foreseen choice on U.S. interest rates in late memory.

Dealers and experts alike have had years to get ready.

So if the Federal Reserve at last does raise rates this week, what could turn out badly?

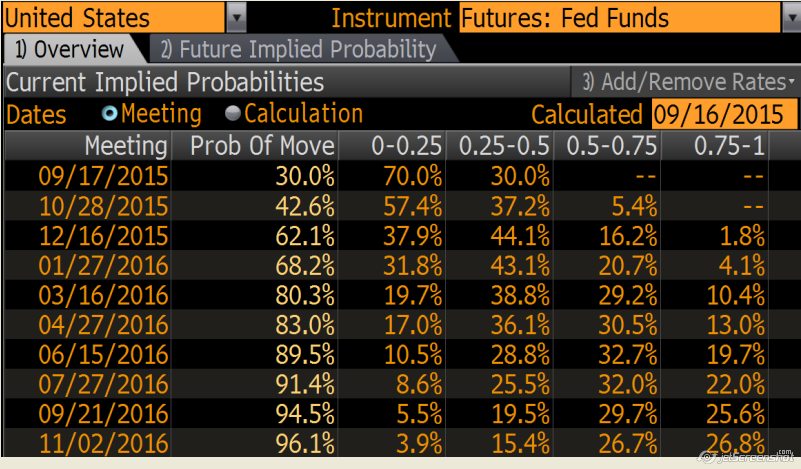

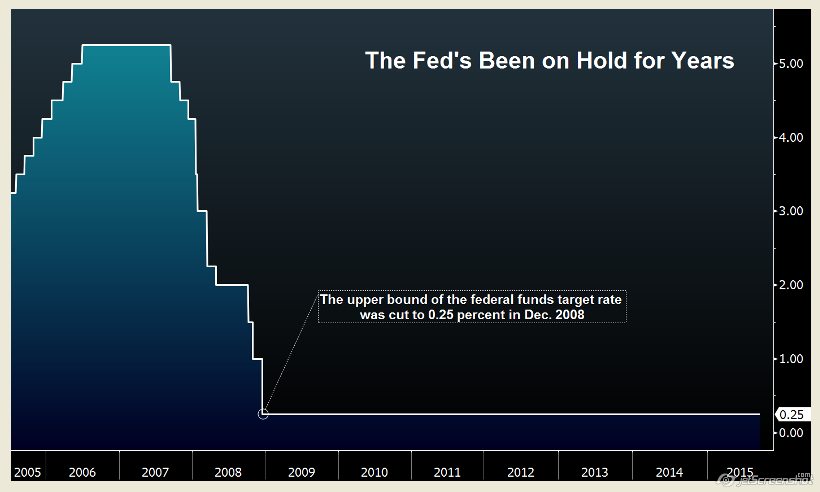

Bounty it appears. Some business watchers, for example, previous U.S. Treasury Secretary Larry Summers are cautioning that money related markets still aren't prepared and could without much of a stretch be found napping. As Summers and others have pointed out, prospects merchants are evaluating in only a 30 percent possibility of a build this week, taking into account the suspicion the viable rate will normal 0.375 percent after liftoff.

Indeed, even the individuals who are moderately idealistic say frail spots financial specialists should be careful about.

"It's similar to a glass that has a split in it," said Aaron Kohli, a premium rate strategist at BMO Capital Markets. "Foreseeing where that split is going to spread is hard to do."

The worry warts have a few thoughts, however.

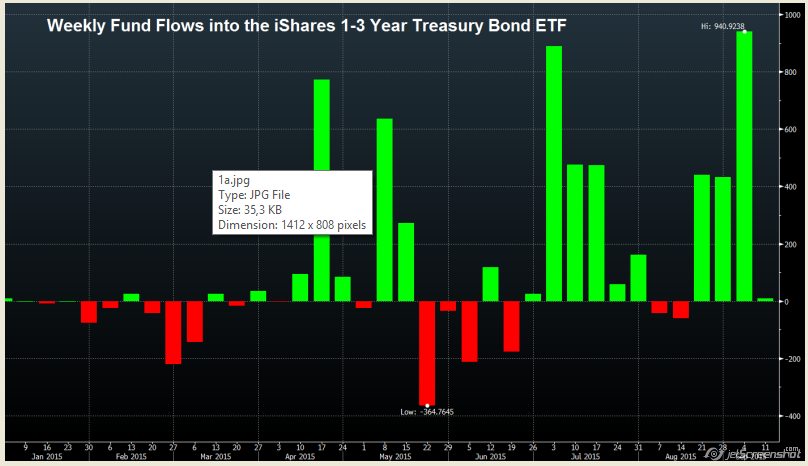

1) Short-End Tantrum: Two years prior, only a notice of closure the Fed's jolt brought on long haul Treasury respects take off. This time around, fleeting U.S. obligation may endure the most, which end up being a monstrous astonishment for the individuals who looked for asylum in the securities amid a month ago's securities exchange defeat. Speculators have emptied more cash into the iShares 1-3 Year Treasury Bond ETF this year than some other trade exchanged obligation store. On Tuesday, the two-year note tumbled as yields took off to the most elevated subsequent to 2011.

There's likewise the danger that offering from worldwide speculators will fuel misfortunes in transient Treasuries if the dollar, which just about everybody hopes to rally as rates rise, droops rather, as indicated by Peter Tchir, the head of full scale procedure with Brean Capital LLC.

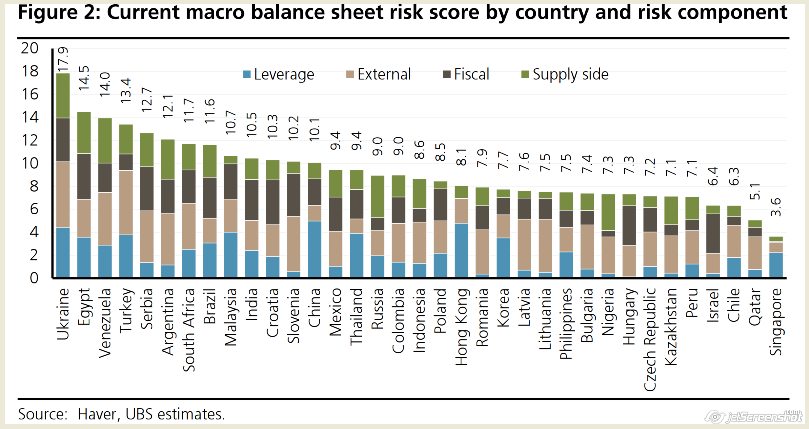

2) Emerging Contagion: Developing nations that depend on outside funding to back their present record shortages are required to face inconvenience, subsequent to higher rates in the U.S. would debilitate to siphon that capital away. In a report a month ago, Morgan Stanley recognized Brazil, Indonesia, South Africa and Turkey as the most hazardous. UBS AG additionally recorded Ukraine, Egypt and Venezuela as the most defenseless, taking into account their obligation and quality of funds.

"They're every lovely dangerou," said BMO's Kohli.

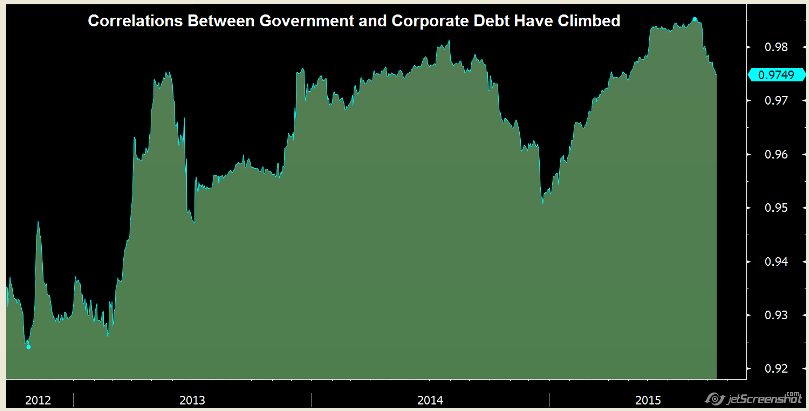

3) Imperiled Borrowers: While it's nothing unexpected that higher rates would support corporate obtaining expenses, higher unpredictability in Treasuries could influence even the most secure organization obligation. A month ago, moves in speculation evaluation bonds were more corresponded to Treasuries than at whatever time in four years. Companies still have a noteworthy financing needs, with borrowers hoping to support $458 billion of takeovers anticipated that would near to year-end.

"On the off chance that we get any huge offering weight in the Treasury market, that'll make it harder for organizations to issue obligation," said Tchir.

4) Structural Seizures: The ascent of PCs and the decrease of Wall Street's bond merchants as customary agents has changed the way of exchanging Treasuries in erratic ways. Last October's "glimmer crash" in Treasury yields is only one sample. A few examiners and strategists say a rate increment could can possibly trigger significantly more unpredictability.

5) Risk of Standing Pat: Even in this way, there's a developing gathering of intellectuals who say keeping rates at zero could prompt much greater dangers. That is on the grounds that a deferral could trigger more turbulence in monetary markets as brokers attempt to decode the Fed's aims. It likewise can possibly goad more hazard taking in regions that are as of now overheated.

"The most pessimistic scenario for me is that they don't go and we need to do this once more," said John Briggs, the head of technique for the Americas at RBS Securities Inc.https://www.mql5.com/en/signals/111434#!tab=history