Analysts: Clarity on Fed decision won't curb stock market volatility

The Federal Reserve will convene its two-day Federal Open Market

Committee beginning on Wednesday to take a decision on the monetary policy, with

analysts divided on the outcome.

“Given the high volatility and very opposite and strong views on the

Fed, I would expect market volatility to continue,” said Paul Nolte,

portfolio manager at Kingsview Asset Management, who projected the

central bank could raise rates on the strength of employments numbers.

Ian Winer, director of equity trading at Wedbush Securities, thinks the Fed "will drive the train on Thursday [but] I do not expect them to raise rates.” Regardless of the Fed’s decision, volatility is likely to pick up, he thinks.

Meanwhile, Kent Engelke, chief economic strategist at Capitol Securities Management Inc., considers volatile market fluctuations could add to factors dissuading the central bank from increasing rates even if it does not reference it in its statement.

“This will not be their public justification for the lack of a rate increase. I believe the FOMC will utilize global economic conditions and the lack of stated inflationary pressures to delay the inevitable,” MarketWatch refers to him as saying.

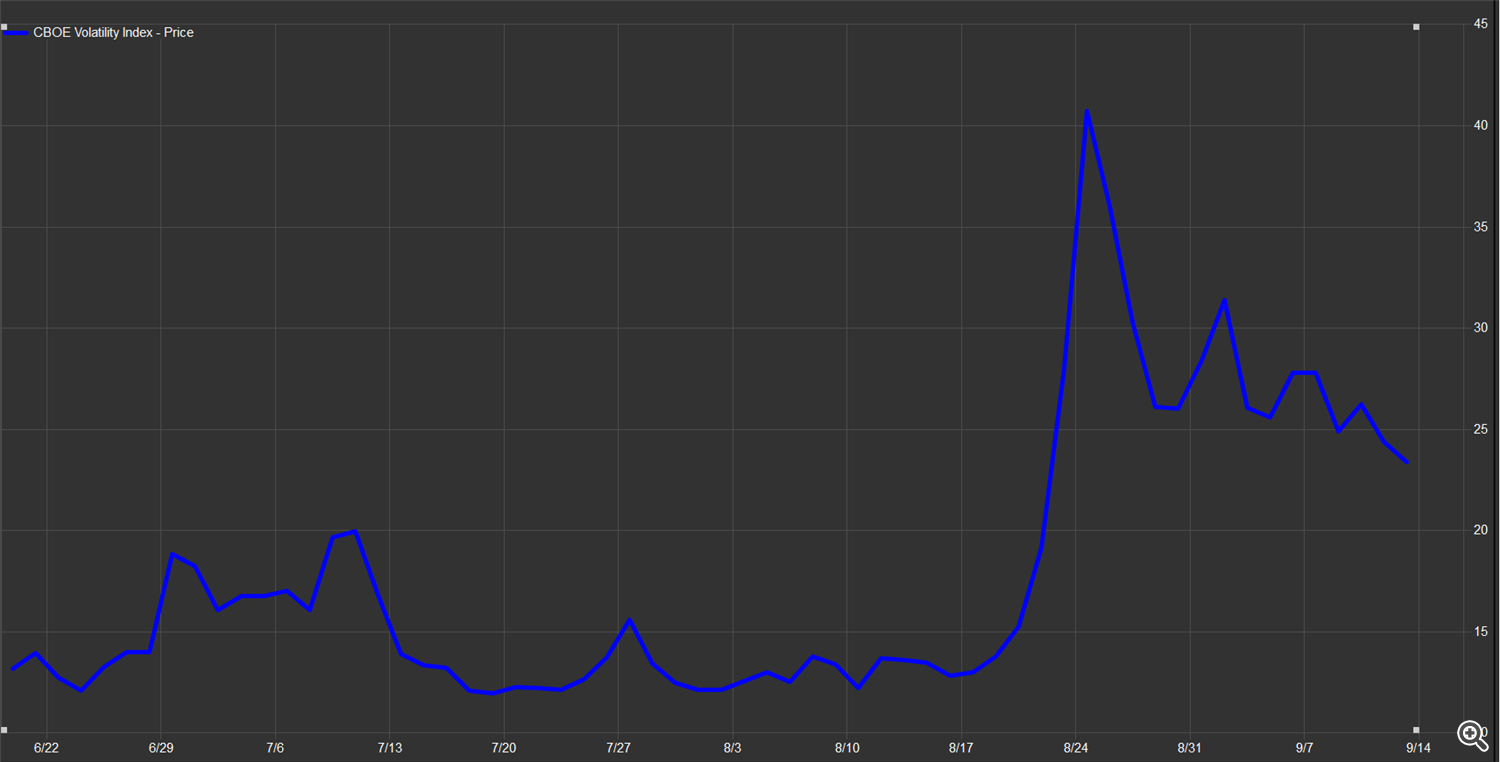

The CBOE Market Volatility Index also referred to as the fear

gauge, surged in late August and has remained higher on uncertainties

ahead of the FOMC, together with growing worries over China’s

sputtering economy.

“Volatility is so extreme that it is making it very difficult to make

rational decisions given the absence of a concrete reason to explain

these violent moves,” said Engelke. High frequency traders and

their preference for a few large-cap shares are to blame for the recent market

swings, he thinks.

Engelke explains that the markets are significantly influenced by high frequency trading and exchange traded funds - which are partially dependent on momentum and moving average lines.

The S&P 500 gained 2.1% over the week to close at 1,961.01 while the Dow Jones Industrial Average posted a weekly gain of 2% to 16,432.89 and the Nasdaq Composite closed out the week 3% higher to 4,822.34.

This week, market strategists mostly expect the S&P 500 to trade in a range of 1,890 to 1,990.