How Low Can Oil Go? Goldman Says $20 a Barrel Is a Possibility.

11 September 2015, 23:02

0

152

Shabby Oil: The Good and Bad for the United States.

While it's not the base-case situation, an inability to lessen creation sufficiently quick may oblige costs close to that level to clear the oversupply, Goldman said in a report messaged Friday while cutting its Brent and WTI rough figures through 2016. The International Energy Agency anticipated that rough stockpiles will lessen in the second a large portion of one year from now as supply outside OPEC decreases by the most since 1992.

"The oil business sector is much more oversupplied than we had expected and we now estimate this surplus to endure in 2016," Goldman investigators incorporating Damien Courvalin wrote in the report. "We keep on survey U.S. shale as the possible close term wellspring of supply alteration."

Goldman trimmed its 2016 evaluation for West Texas Intermediate to $45 a barrel from a May projection of $57 on the desire that OPEC generation development, versatile supply from outside the gathering and moderating interest extension will drag out the overabundance. The bank additionally diminished its 2016 Brent unrefined forecast to $49.50 a barrel from $62.

WTI for October conveyance fell as much as $1.16, or 2.5 percent, to $44.76 a barrel on the New York Mercantile Exchange and is setting out toward a week by week decay of 2.2 percent. Costs are down 15 percent this year.

Cynicism Deepens

"We now trust the business sector requires non-OPEC creation to move from our earlier desire of humble development to substantial decreases in 2016," Goldman said. "The instability on how and where that change will happen has expanded."

The Paris-based IEA estimate Friday that generation outside the Organization of Petroleum Exporting Countries will fall by 500,000 barrels a day to 57.7 million in 2016. Shale oil creation in the U.S. will drop by 385,000 barrels a day one year from now as an unrefined cost beneath $50 a barrel "pummels brakes" on years of development, the office said in its month to month business sector report.

For the worldwide surplus to end by the final quarter of 2016, U.S. yield should decrease by 585,000 barrels a day, with other non-OPEC generation falling by a further 220,000 barrels a day, Goldman said.

The U.S. pumped 9.14 million barrels a day of oil a week ago, as indicated by information from the Energy Information Administration. While the EIA this week cut its 2015 yield figure for the country by 1.5 percent to 9.22 million barrels a day, creation this year is still anticipated to be the most astounding subsequent to 1972. U.S. unrefined stockpiles stay around 100 million barrels over the five-year regular normal.

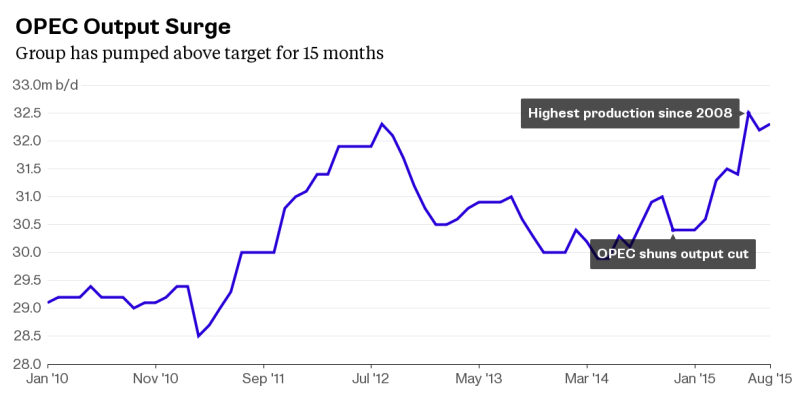

Saudi Arabia, Iraq and Iran will drive supply development from OPEC, Goldman said. The gathering, which supplies around 40 percent of the world's rough, has delivered over its 30-million-barrel-a-day portion for as far back as 15 months.

Iranian Oil Minister Bijan Namdar Zanganeh has pledged to build yield by 1 million barrels a day once authorizes are evacuated as the country tries to recover piece of the overall industry.https://www.mql5.com/en/signals/111434#!tab=history