Current trend

Late in yesterday's American session, US stock indices rose sharply: NasdaqComposite up 2.7%, S&P 500 up 2.5%, DJIA up 2.4%, DJIA up 2.4%, S&P up 2.5%. The growth continued through the Asian session today: NikkeiStockAverage gained 1.9% on opening. Increased risk appetite on the markets allows the USD to strengthen, while the GBP is supported by a decline in the EUR/GBP cross pair.

Today, Great Britain releases Industrial Production and Trade Balance statistics. On Thursday, the Bank of England sets the UK interest rate, which is expected to be kept unchanged at 0.5%, and publishes Monetary Policy Committee Rate Statement, which is likely to determine the GBP dynamics until 17 September, when the Federal Reserve announces its interest rate decision.

Support and resistance

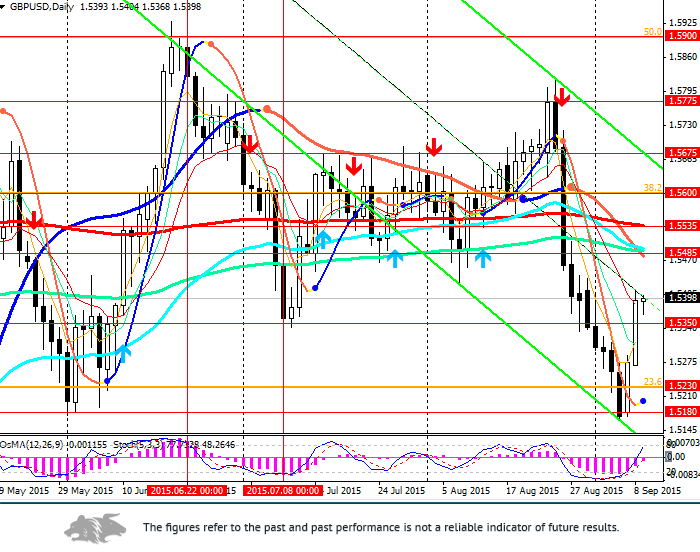

On the 4-hour chart, OsMA and Stochastic are turning to sales. On the daily chart, the indicators give buy signals.

While the GBP/USD pair remains below the support levels of 1.5535 (ЕМА200), 1.5485 (ЕМА144, ЕМА50 on the daily chart), it may continue declining.

Negative UK releases may push the pair down to 1.5230 (23.6% Fibonacci), 1.5100 and 1.4700 (year lows). Negative US releases, on the contrary, may allow the pair to strengthen higher than the levels of 1.5535 and 1.5600.

Support levels: 1.5350, 1.5300, 1.5230.

Resistance levels: 1.5485, 1.5500, 1.5535, 1.5550, 1.5600.

Trading tips

Open short positions from the level of 1.5330 with targets at 1.5310, 1.5290, 1.5230 and stop-loss at 1.5370.

Place alternative pending buy order at the level of 1.5520 with targets at 1.5535, 1.5600, 1.5670, 1.5900 and stop-loss at 1.5470.