In case you're new here, you may need to subscribe to get day by day upgrades. A debt of gratitude is in order for going by!

EUR/USD saw more tempests in the first week of September proceeding onward beat level occasions from both sides of the Atlantic. A blend of German and French information anticipates us now. Here is a standpoint for the highlights of this current week and an upgraded specialized examination for EUR/USD.

Draghi dragged the euro around bringing down gauges, slackening bond purchasing guidelines and inspiring prepared to accomplish more. He richly joined the coin wars without focusing on a major move. The euro kept exchanging as a place of refuge, ascending with securities exchange falls and falling when things got to be more settled. PMIs were not so persuading but rather unemployment fell. Will this keep weighing on the euro? A considerable measure relies on upon the US, which is anticipating the Fed after the NFP, which was entirely blended. How about we begin:

Overhauls:

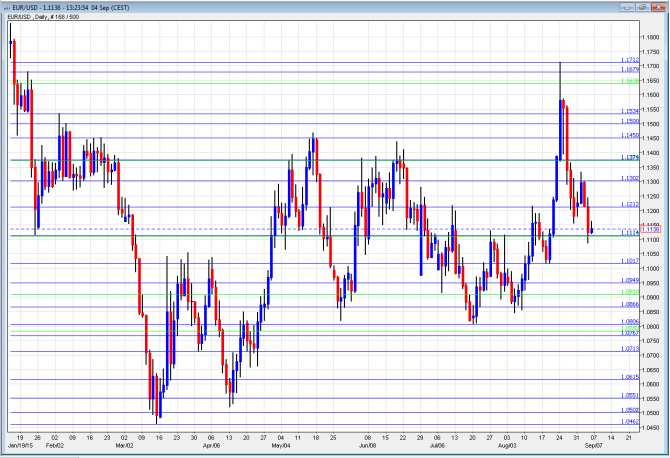

EUR/USD day by day chart with backing and resistance lines on it. Snap to amplify:

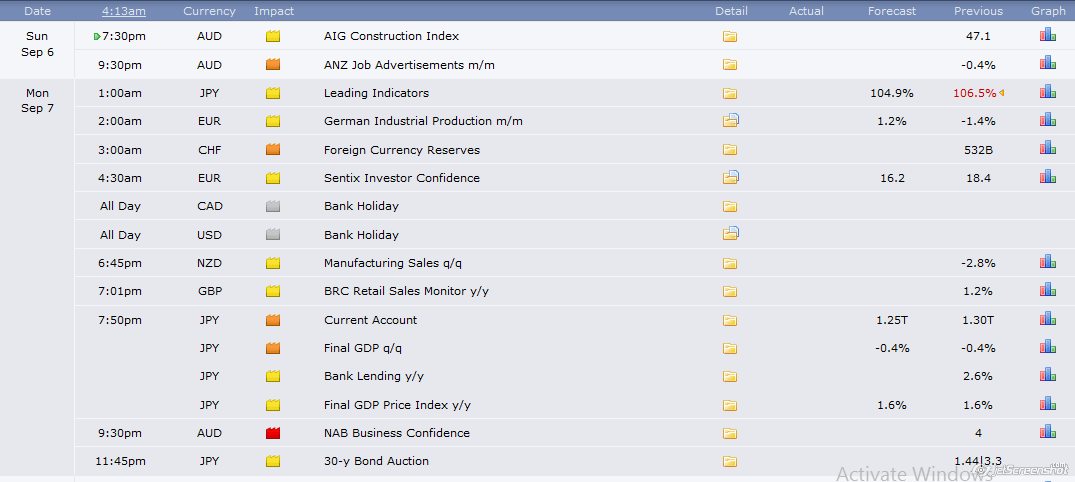

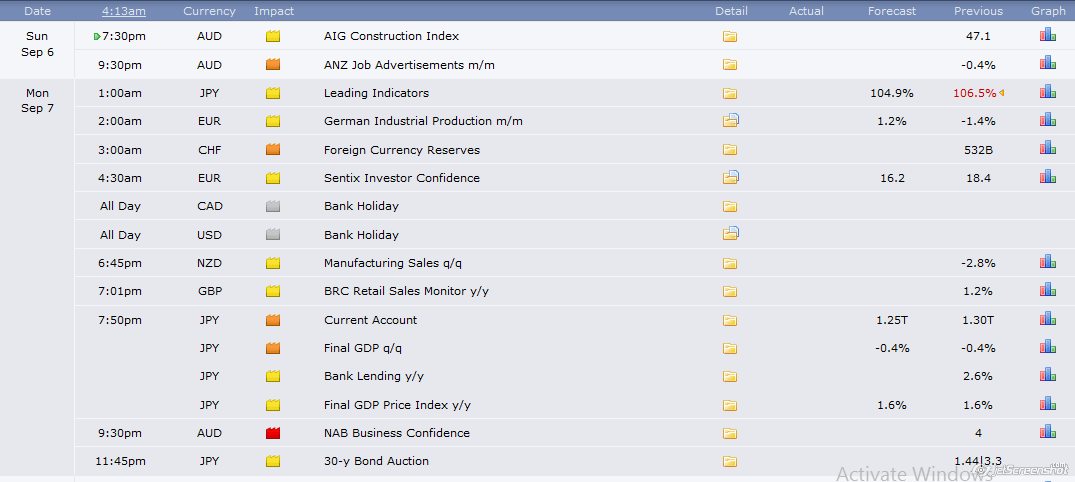

German Industrial Production: Monday, 6:00. The euro-zone's powerhouse has seen a slide of 1.4% in its modern yield in June. The figure for July will probably see a skip go down with +1.2%.

Sentix Investor Confidence: Monday, 8:30. The 2800 solid study demonstrated another slow down in good faith, with a score of 18.4 focuses in August, beneath desires. Another side is on the cards now, to 16.2 focuses.

German Trade Balance: Tuesday, 6:00. Germany appreciates a wide exchange surplus and this keeps the euro offer now and again. After +22 billion in June, a comparative number is on the cards for July: 21.8 billion.

French Trade Balance: Tuesday, 6:45. In spite of Germany, France has an exchange deficiency, yet at any rate it is pressing. The late number was 2.7 billion in June. A 3.2 billion shortage is on the cards now. Note that the French government will discharge its financial plan in the meantime, and a deficiency is likely here too.

French Industrial Production: Thursday, 6:45. The progressions in French modern yield are less claimed than in Germany. A drop of 0.1% was seen in June and an ascent of 0.3% is on the cards now.

Money priest gatherings: Friday with all EU 28 clergymen and Saturday for the euro-zone serves, the Eurogroup. The money pastors of the euro-zone nations meet to talk about current undertakings. They were in the spotlight around the statures of the late Greek emergency in June and July and are presently fairly far from the spotlight. On the other hand, the Greek decisions are entirely close and the delicate obligation inquiry is dependably on the table.

German Final CPI: Friday, 6:00. The beginning number leaving Germany demonstrated no adjustment in costs m/m and this will probably be affirmed at this point. In the meantime the German Wholesale Price Index is discharged and it is relied upon to demonstrate an ascent of 0.2% after 0.1% in advance.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar commenced the week by broadening its additions and coming to a high crest of 1.1712. It then turned the distance down and bottomed out around the 1.1215 level said a week ago. Be that as it may, it didn't end there, with Draghi sending it to the 1.10 handle.

Live graph of EUR/USD:

Specialized lines through and through:

Because of compelling unpredictability, we begin from higher ground this time: 1.1875 was the low found in 2010 furthermore topped the pair recently. The August high of 1.1712 is the following line.

1.1680 topped the pair in January on its way down. The following line is a reasonable separator of reaches: 1.1535. It was most recently seen in January too.

The precise cycle 1.15 level is of significance on account of its mental part. It is firmly trailed by 1.1460 that served as resistance before in the year.

The memorable line of 1.1373 (from November 2003) still has a part as resistance. 1.13, the round number, demonstrated its quality in topping a recuperation endeavor in ahead of schedule September.

1.1215, which topped the pair both in June and in August is clear resistance. It is trailed by a low seen in January of 1.1113 which is almost 0.90 on USD/EUR.

1.1050 profits to the outline in the wake of serving as a going stone for the pair to ascend to higher ground. 1.0950 is an essential line in the extent.

1.0865 gave some backing in late May and is feeble backing before a more grounded line: 1.0810, which was the base in July additionally pleasantly corresponds with the low found in May and is solid backing..

The following line is 1.0760, which was the low point in both July and August 2003. 1.0715 joins the diagram after incidentally topping the pair in April 2015.

I am bearish on EUR/USD

As we composed a week ago, the ECB likewise joined the coin wars. With quick steps and more QE approaching, the euro could confront huge downwards weight from the national bank, regardless of the fact that the Fed forgoes a prompt rate climb. As we would see it, there is a decent risk of a "dovish rate climb". https://www.mql5.com/en/signals/111434#!tab=history

EUR/USD saw more tempests in the first week of September proceeding onward beat level occasions from both sides of the Atlantic. A blend of German and French information anticipates us now. Here is a standpoint for the highlights of this current week and an upgraded specialized examination for EUR/USD.

Draghi dragged the euro around bringing down gauges, slackening bond purchasing guidelines and inspiring prepared to accomplish more. He richly joined the coin wars without focusing on a major move. The euro kept exchanging as a place of refuge, ascending with securities exchange falls and falling when things got to be more settled. PMIs were not so persuading but rather unemployment fell. Will this keep weighing on the euro? A considerable measure relies on upon the US, which is anticipating the Fed after the NFP, which was entirely blended. How about we begin:

Overhauls:

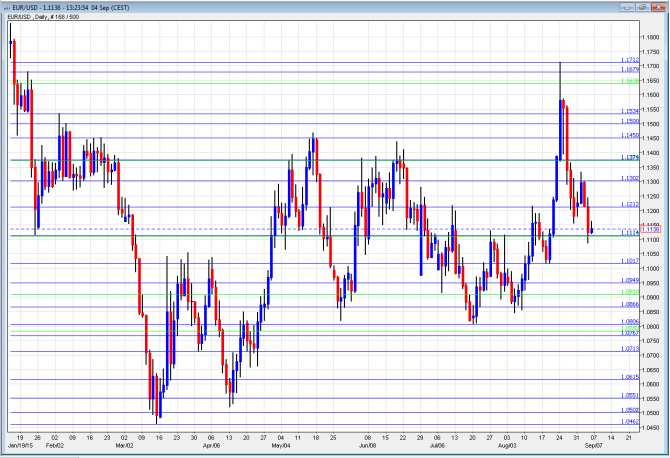

EUR/USD day by day chart with backing and resistance lines on it. Snap to amplify:

German Industrial Production: Monday, 6:00. The euro-zone's powerhouse has seen a slide of 1.4% in its modern yield in June. The figure for July will probably see a skip go down with +1.2%.

Sentix Investor Confidence: Monday, 8:30. The 2800 solid study demonstrated another slow down in good faith, with a score of 18.4 focuses in August, beneath desires. Another side is on the cards now, to 16.2 focuses.

German Trade Balance: Tuesday, 6:00. Germany appreciates a wide exchange surplus and this keeps the euro offer now and again. After +22 billion in June, a comparative number is on the cards for July: 21.8 billion.

French Trade Balance: Tuesday, 6:45. In spite of Germany, France has an exchange deficiency, yet at any rate it is pressing. The late number was 2.7 billion in June. A 3.2 billion shortage is on the cards now. Note that the French government will discharge its financial plan in the meantime, and a deficiency is likely here too.

French Industrial Production: Thursday, 6:45. The progressions in French modern yield are less claimed than in Germany. A drop of 0.1% was seen in June and an ascent of 0.3% is on the cards now.

Money priest gatherings: Friday with all EU 28 clergymen and Saturday for the euro-zone serves, the Eurogroup. The money pastors of the euro-zone nations meet to talk about current undertakings. They were in the spotlight around the statures of the late Greek emergency in June and July and are presently fairly far from the spotlight. On the other hand, the Greek decisions are entirely close and the delicate obligation inquiry is dependably on the table.

German Final CPI: Friday, 6:00. The beginning number leaving Germany demonstrated no adjustment in costs m/m and this will probably be affirmed at this point. In the meantime the German Wholesale Price Index is discharged and it is relied upon to demonstrate an ascent of 0.2% after 0.1% in advance.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar commenced the week by broadening its additions and coming to a high crest of 1.1712. It then turned the distance down and bottomed out around the 1.1215 level said a week ago. Be that as it may, it didn't end there, with Draghi sending it to the 1.10 handle.

Live graph of EUR/USD:

Specialized lines through and through:

Because of compelling unpredictability, we begin from higher ground this time: 1.1875 was the low found in 2010 furthermore topped the pair recently. The August high of 1.1712 is the following line.

1.1680 topped the pair in January on its way down. The following line is a reasonable separator of reaches: 1.1535. It was most recently seen in January too.

The precise cycle 1.15 level is of significance on account of its mental part. It is firmly trailed by 1.1460 that served as resistance before in the year.

The memorable line of 1.1373 (from November 2003) still has a part as resistance. 1.13, the round number, demonstrated its quality in topping a recuperation endeavor in ahead of schedule September.

1.1215, which topped the pair both in June and in August is clear resistance. It is trailed by a low seen in January of 1.1113 which is almost 0.90 on USD/EUR.

1.1050 profits to the outline in the wake of serving as a going stone for the pair to ascend to higher ground. 1.0950 is an essential line in the extent.

1.0865 gave some backing in late May and is feeble backing before a more grounded line: 1.0810, which was the base in July additionally pleasantly corresponds with the low found in May and is solid backing..

The following line is 1.0760, which was the low point in both July and August 2003. 1.0715 joins the diagram after incidentally topping the pair in April 2015.

I am bearish on EUR/USD

As we composed a week ago, the ECB likewise joined the coin wars. With quick steps and more QE approaching, the euro could confront huge downwards weight from the national bank, regardless of the fact that the Fed forgoes a prompt rate climb. As we would see it, there is a decent risk of a "dovish rate climb". https://www.mql5.com/en/signals/111434#!tab=history