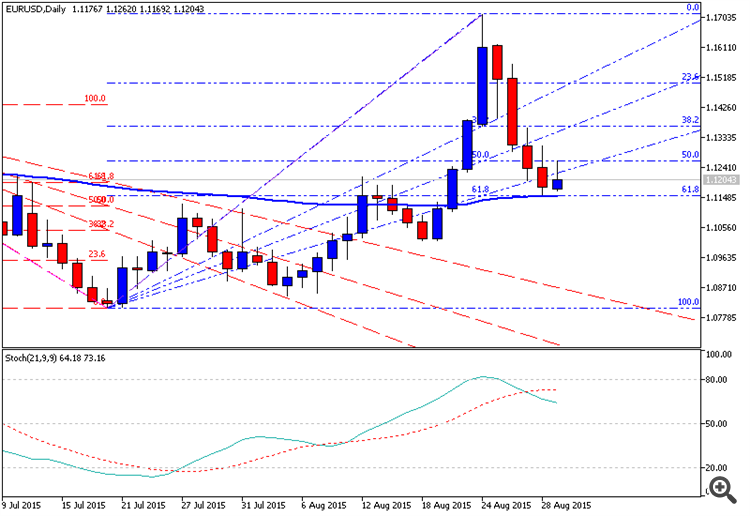

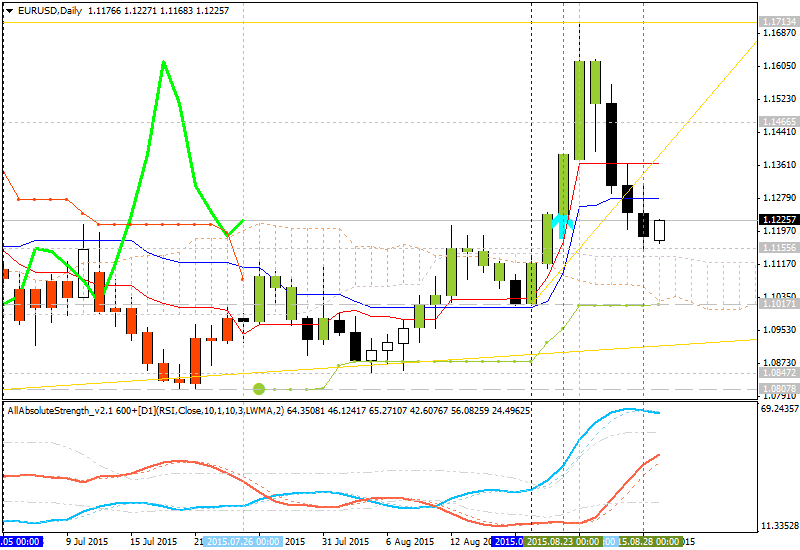

EURUSD Technical Analysis 2015, 30.08 - 06.09: correction for ranging

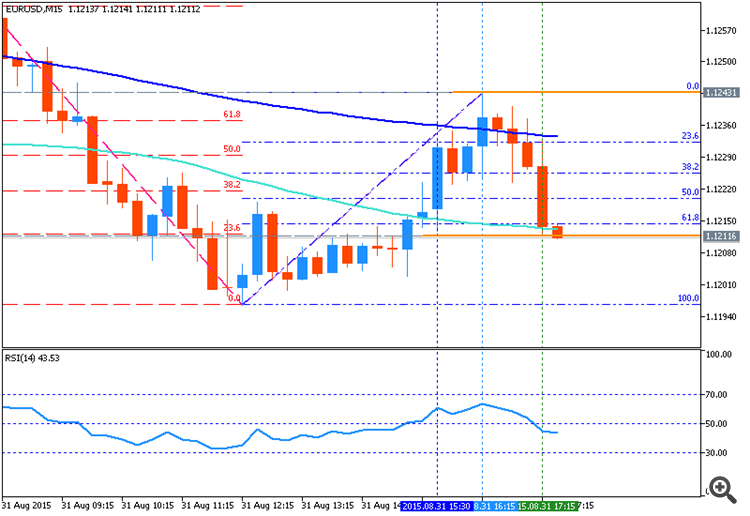

Daily price is on primary bullish for secondary correction

which was started in the beginning of the last week: the price is trying

to break Ichimoku cloud from above to below with Chinkou Span line to

be moved close to the price for good possible breakdown. The key

resistance level for the bullish trend to be continuing is 1.1713; the

key support level for the price to be fully reversed to the bearish

market condition is 1.0807.

D1 price - correction:

- Tenkan-sen line is above Kijun-sen line for bullish market condition.

- Absolute Strength indicator's data is estimating the bullish ranging market condition.

- Chinkou Span line is located above and near the price and indicating the breakdown to bearish reversal by direction.

- 'Reversal' Senkou Span line as the border between the primary bullish and the primary bearish on the chart is located near below the price.

- Nearest key support level is 1.0807.

- Nearest key resistance level is 1.1713.

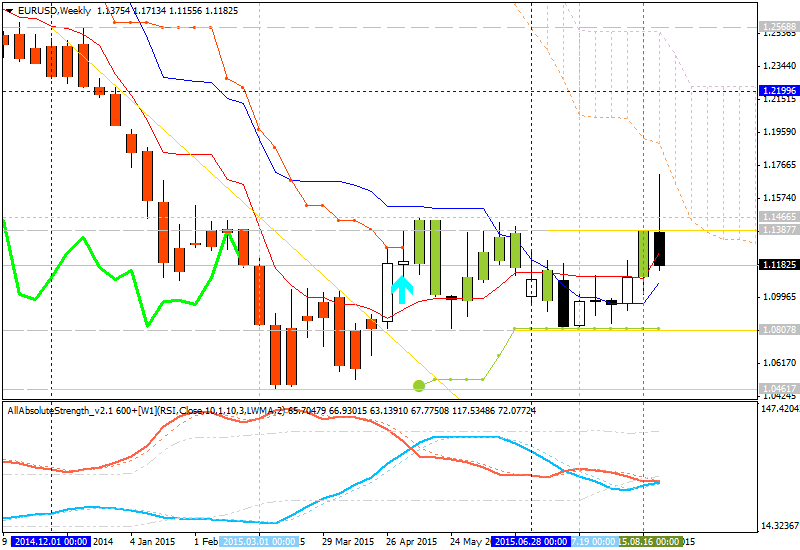

W1 price

is on bearish market condition with secondary ranging between 1.0807 bearish support level and 1.2199 bullish resistance level.

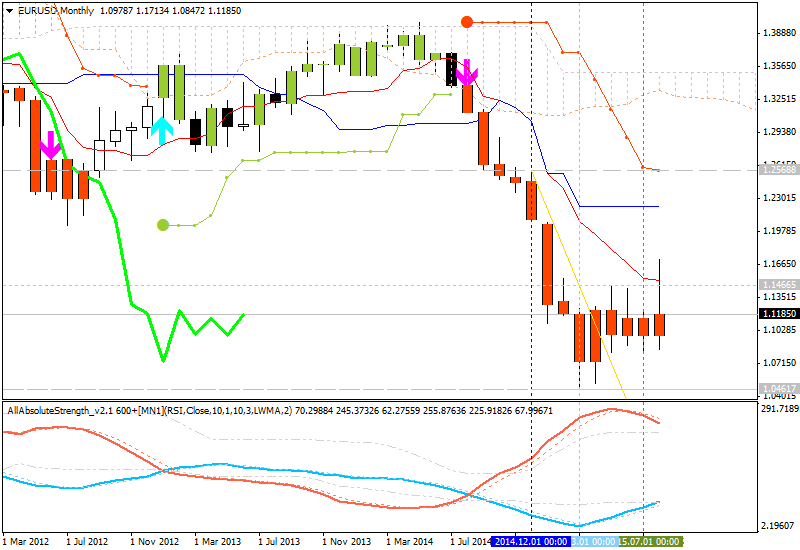

MN price

is on ranging bearish with 1.0461 support level.

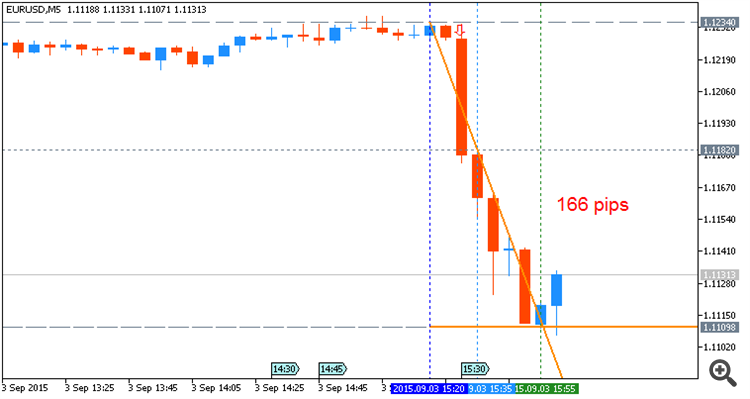

If D1 price will break 1.0807

support level on close D1 bar so we may see the reversal of the price movement to the primary bearish market condition.

If D1 price will break 1.1713 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels.

- Recommendation for long: watch close D1 price to break 1.1713 for possible buy trade

- Recommendation

to go short: watch D1 price to break 1.0807 support level for possible sell trade

- Trading Summary: ranging

| Resistance | Support |

|---|---|

| 1.1713 (D1) | 1.0807 (D1) |

| 1.2199 (W1) | 1.0807 (W1) |

| 1.2568 (MN1) | 1.0461 (MN1) |

SUMMARY : correction