Current trend

Oil and commodities prices grew amid recovering stock market indices, which supported the NZD/USD pair. The pair also received support from uncertainty regarding start dates of the interest rate increase in the US and growing prices for dairy products.

Nevertheless, the medium-term trend suggests that short positions look safer at present.

Important publications for today include Personal Consumption Expenditures Prices, the second quarter GDP data and Jobless Claims for the last week of August in the US.

Support and resistance

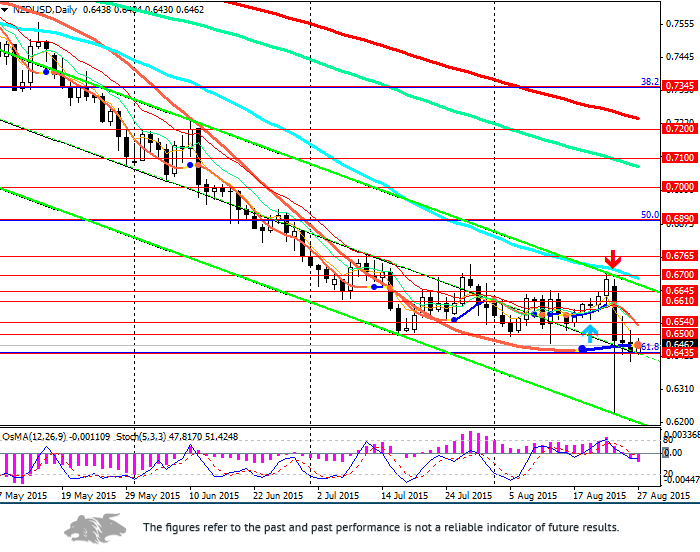

The pair broke down the bottom border of the range 0.6765-0.6510 where it remained since 1 July, and stabilised near the level of 0.6435.

OsMA and Stochastic on the daily chart turned to sales, while on the 4-hour chart they are turning to purchases, thus indicating that the intraday upward correction is not over yet.

Today’s correction can continue up to the levels of 0.6500, 0.6540. The breakout of the level of 0.6890 would allow the pair to grow to 0.7000, 0.7100, 0.7250, while the consolidation above the level of 0.7345 (38.2% Fibonacci) could resume an upward trend in the pair.

The breakdown and consolidation below the level of 0.6435 would let the pair fall to 0.6200, 0.6000 (2006 lows), 0.5000 (2009 lows).

Support levels: 0.6435 (61.8% Fibonacci), 0.6400.

Resistance levels: 0.6500, 0.6540 (ЕМА200 on the hourly chart), 0.6610, 0.6650, 0.6700 (ЕМА50 on the daily hart), 0.6725, 0.6765, 0.6800.

Trading tips

Open short positions from the current levels and from 0.6500, 0.6540 with the target at 0.6310 and stop-loss at 0.6570.

Long positions are not considered yet.