Current trend

Last week, the GBP strengthened against the USD, reaching new local highs since the beginning of July. The "bullish" dynamics was triggered by the instability of the US dollar amid the publication of various macroeconomic and news releases.

The British currency was supported by unexpectedly positive UK Consumer Price Index. However, later on, Retail Sales statistics weakened the "bullish" activity. At the beginning of this week, the upward trend is not so strong either.

Support and resistance

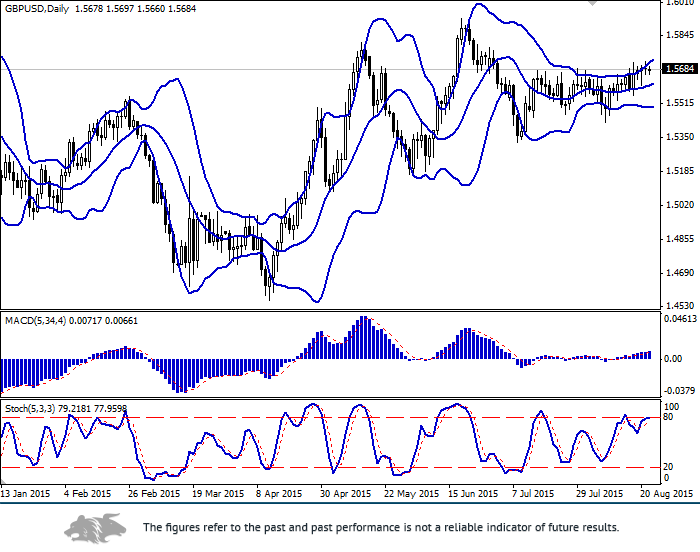

On the daily chart, Bollinger Bands indicator is growing; the price range is widening, but still it is too narrow for the British pound. The indicator is giving a weak sell signal. Sell orders may be placed within a correction in the short run.

MACD is growing, giving a "bullish" signal. Long positions are still valid in the short run. At the same time, it is not recommended to open new positions right now.

Stochastic is approaching the overbought zone, indicating a possibility of a correctional rollback in the nearest future.

Support levels: 1.5659, 1.5600 (near 20 August local low), 1.5558 (18 August low), 1.5520, 1.5465, 1.5400, 1.5330 (8 July low).

Resistance levels: 1.5700 (the nearest mark), 1.5722 (21 August current high), 1.5770 и 1.5800 (near 24 August high).

Trading tips

Open long positions when the price breaks through and rebounds at 1.5700 with the target at 1.5800 and stop-loss at 1.5600.

Open short positions when the price breaks down the level of 1.5600 with the target at 1.5465 and stop-loss at 1.5700.