BNP Paribas for USD - 'We expect to be a choppy second half of August'

18 August 2015, 18:03

1

1 450

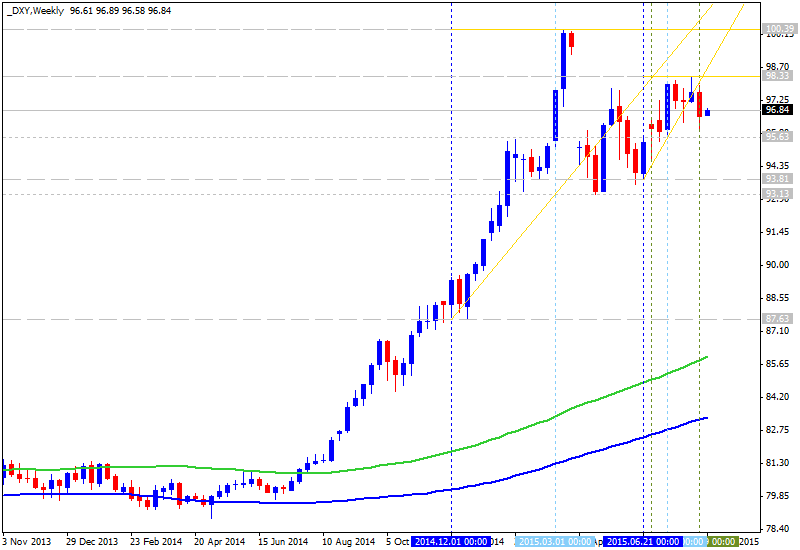

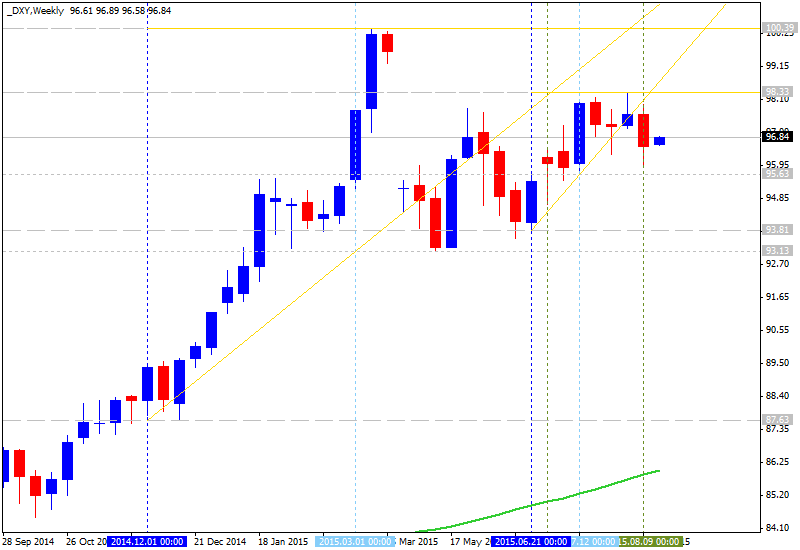

BNP Paribas are forecasting the strong USD but with the secondary ranging market condition - just because of China news on Fed expectations:

-

"The underlying effective Fed funds rate has also been drifting higher

over the past two weeks, reaching 15bp and suggesting some of the move

in rates market pricing could reflect expectations for a move within the

target range rather than a hike in the target."

-

"The minutes to the Fed’s July meeting on Wednesday will be

closely watched for more insight into Committee thinking on the timing

of hikes, while a speech from San Francisco Fed President John

Williams on Thursday from a conference in Indonesia may give some

insight into how Fed thinking has been affected by CNY developments."

- "We remain patiently bullish on the USD through what we expect to be a choppy second half of August."

As we see from the chart - Dollar Index Future (DXY) is located above 100-SMA/200-SMA for bullish condition and, seems, this bullish condition will be continuing in August as well. But the choppy market was started in the end of April this year and there is no any indication that this choppy condition will be finished by the beginning of September. Thus, we can confirm the forecast made by BNP Paribas.