"If you aint cheating, you aint trying", said a Barclays trader... before his bank got a $2.4bn fine

A new era for the currency trading has emerged. Now, for the first time, traders are terrified of their compliance departments, representatives of which may now sit on their trading desks, while the former customers choose to use a wider range of banks.

Today, after $10 bn in fines, release of an avalanche of humiliating staff transcripts, as well as ruined careers, forex trading industry believes it is high time to grow up, says the Financial Times.

The currency exchange has been dusted down and pushed into an era of scrupulous transparency.

When regulatory probes into traders’ misconduct began in 2013, banks started to enforce a more severe culture. First, regulators banned the use of electronic chat rooms with other traders making it clear that big brother was watching. Almost every serious bank in the business fired dozens of traders, sometimes for minor transgressions, but mostly for types of behaviour that had been well-established and known by their bosses.

The first fines were imposed last November on the US, UK and Switzerland.

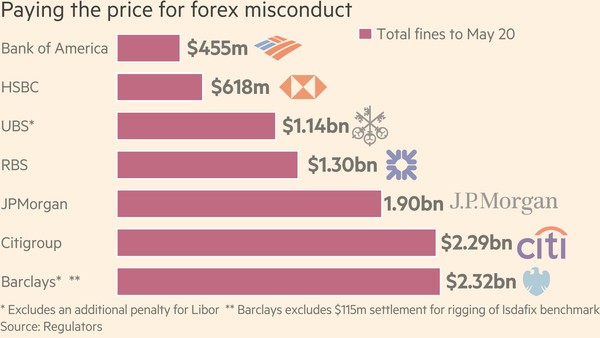

The latest series of fines in the U.S. — a total $5.6bn put on Bank of America, UBS, RBS, JPMorgan, Barclays and Citigroup on May 20 — is somewhat a reminder of why this current age of boring banking had to come about, says the Financial Times.

Source: Financial Times

“I

suppose that given the severity of what has occurred, it is

unsurprising that banks have gone from the sublime to the ridiculous,”

said Paul Chappell, founder of currency fund-management firm C-View.

Banks were fine with letting their clients know what kind of flows

were moving around the market for many years. No names, just lots of

impish code names, and enough information to help form a good guess - that was an unspoken rule.

Traders

once made it clear to each other which clients were active in the

market on a particular day using childish code names. The Bank of Korea was referred to as “Dog buys euros”. “Palindrome” was the nickname for George Soros. “Geneva boys” referred to hedge fund Brevan Howard.

Punctuation marks designed to look like chop sticks “\ /” pointed to the

People’s Bank of China, etc.

Those bankers will hardly be pities given their lucrative salaries, huge bonuses and unprecedented buffoonery. However, some say that there are occasions when communication between traders would be helpful, like a chit-chat could have helped to calm the market madness that broke out in January, when the Swiss National Bank removed its upper limit on the franc, sending the currency soaring by an unprecedented 30 per cent against the euro.

Others consider traders’ new reluctance to take on risk is contributing to pockets of vanishing liquidity, a topic that is starting to spur concerns from central bankers around the world.

Before the scandals, some traders used electronic chat rooms to share details of trades clustered around

benchmark calculation points, so that to help each other evade

losses or make money. Today, humans are being completely excluded from this process. Several

banks including Deutsche Bank and Credit Suisse, which have never been

fined or proved to have misconducted, but

also JPMorgan, which has been fined repeatedly, have sought to remove

humans from the process. Computers match up trades, algorithms work out

how to process them, and sometimes, a fee is imposed to clients.

The cleaning is extending into rates markets, in a way as a result of the Libor settlements in 2012. May 20's settlements relating to attempted abuse of another benchmark, Isdafix, have added to the rage.

Bond market customers even say they are also getting the silent treatment from once chatty banks. “We get flow information, but it’s significantly more subdued. Banks have become paranoid,” said one bonds-focused hedge fund manager.

“It’s to the point that funds are telling banks if they talk too much. If I am in a chat, with 50 other people, and two of them discuss dodgy stuff, then I am liable. Not as much as them, but [if anything happens] the regulators will hunt me down,” he said. “So screw that.”