Forex Swing Trading Strategies - Candlestick Trading, Trend Following, Mean Reversion Trading Strategy and Bollinger Band Trading

Swing trading is very popular for Forex traders for two main

reasons. Firstly, Forex swing trading strategies usually contain entry

and exit techniques that require checking the chart perhaps only once or

twice each day, or at most every few hours. This relatively relaxed

schedule is very suitable for people with busy lives and full-time jobs.

Forex Candlestick Trading

Most new traders that go for swing trading are taught to look for

certain Forex candlestick formations, in alignment with support and

resistance. In this style, traders are taught to be extremely selective

in picking trades, and exhorted to stay on the sidelines unless

everything looks perfect.

It is certainly possible to make money trading like this, but it is

hard for most people to make more than just a little profit with this

style. There are several reasons for this:

- Very few set-ups look perfect, so many trades are not taken.

- This style can be very difficult psychologically, especially when the trader sits on the sidelines and sees a great move play out. This can lead to an overly itchy trigger finger on the next trade.

- Candlestick analysis on its own is mostly useless: it must be combined with support and resistance, trend, time of day or other factors. ALL of these other factors are in themselves more powerful than candlesticks, yet the candlesticks are the number one factor traders are taught to focus on.

- Fundamental and quantitative factors are usually ignored.

Trend Trading

Trend trading is the most easy and natural way for new traders to profit in the retail Forex market. However, there are a lot of misconceptions about how to trend trade Forex, which usually come from the misapplication of methods that are more suitable to trading stocks or commodities. Forex pairs tend to move much less than stocks and commodities, therefore applying traditional trend trading breakout strategies indiscriminately will almost certainly lead to losses over time.

Swing traders are looking to exit from winning trades from one to a few days after entry. It is very problematic to apply this time frame to trend trading, as in Forex trend trading profits are statistically derived from the big winners which are allowed to run.

Mean Reversion Trading

An alternative to looking for candlesticks patterns or breakouts is instead to apply a mean reversion trading strategy. This kind of trading tends to be overlooked, but statistics show why it can be applied profitably in Forex, especially in swing trading. Historical data shows that the best swing trading indicators tend to be mean reversion indicators.

A very simple mean reversion trading strategy could be to wait for the price to become over-extended. There are many indicators that can be used to measure this, but for now let’s stick with something simple: just the price. Over the past 6 years, the chance of any of these Forex pairs moving in value by more than 2% from a weekly open to a weekly close is about 1 in 8: it is a fairly rare event. Let’s say that every time this happened, we opened a trade to last just one week right away, in the opposite direction to that move greater than 2% that just happened. This mean-reversion strategy trading generated an average profit per trade of 0.25%.

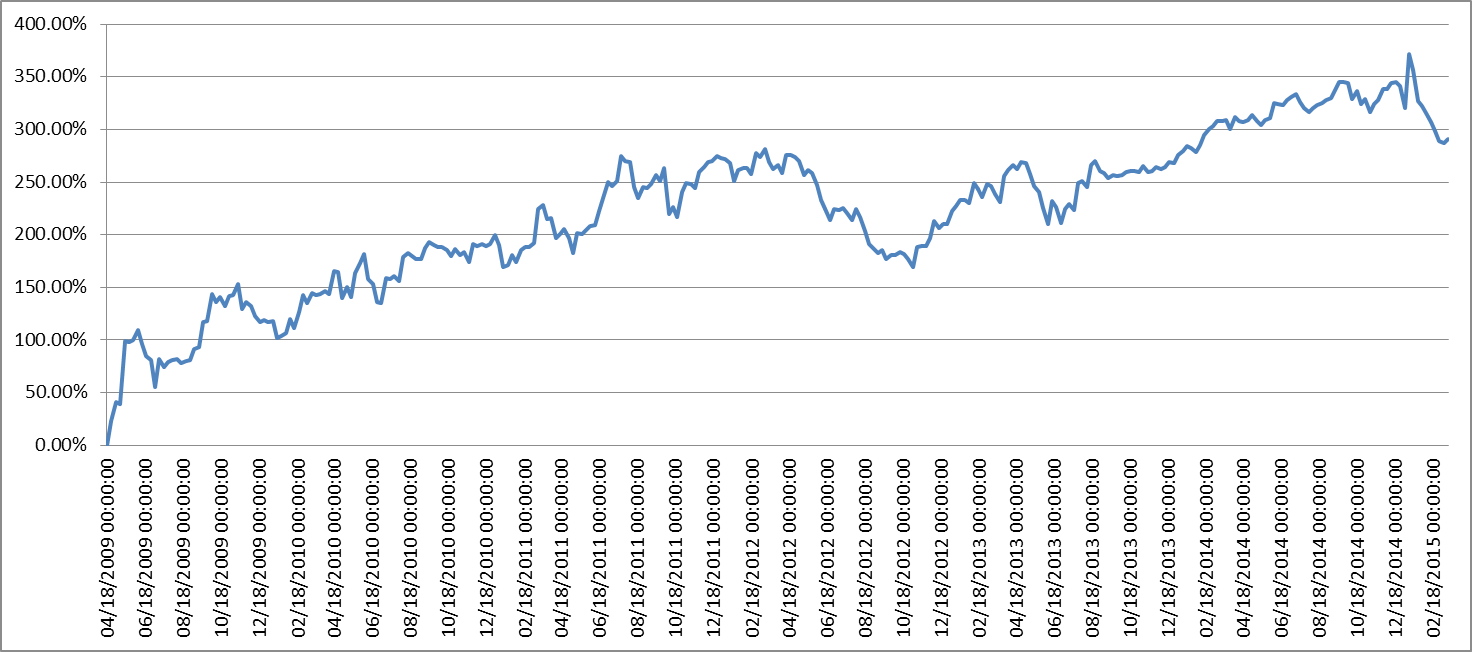

If we only entered trades in the direction of the 3 month trend when the previous week closed in the same direction as the trend, the strategy becomes unprofitable, with an average loss per trade of -0.02%. However if we only entered trades in the direction of the 3 month trend when the previous week closed against the trend direction, the strategy becomes even more profitable, with an average profit per trade of 0.07%. Note also that this has produced relatively steadily rising equity curve over the years:

Bollinger Band Trading

One of the most popular mean-reversion indicators is the Bollinger Band. Classically, when the bands are relatively wide, in Bollinger band trading you enter a position when the price is reversing off an outer band, and look to exit when the price is in the vicinity of the central band. There are additional methods of Bollinger band analysis that can also be used.