Former Federal Reserve Chairman Ben Bernanke has taken to blogging and has already caused quite a splash tackling some of the crucial economic questions facing the world today.

Last week he attempted to tackle the issue of the significant German trade surplus. Sadly, he fell into the same traps as many other bloggers, largely by not looking at the data and by not tackling the key issues underlying the surplus.

Germany does not run a surplus with the Eurozone

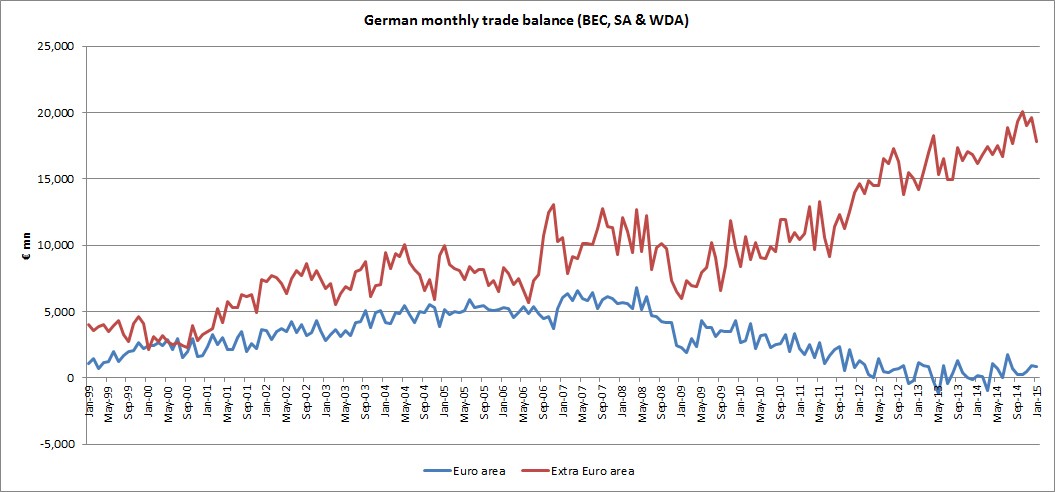

It is infuriating how few people know this and continue to discuss the topic without looking into the data. But as the chart below shows, Germany does not actually run a trade surplus with its Eurozone partners. In fact, since 2012 the monthly trade between Germany and the rest of the Eurozone has roughly been in balance.

This undermines one of Bernanke’s biggest gripes – that Germany is propagating “persistent imbalances” in the Eurozone. As the chart shows, the imbalance issue (at least in terms of trade) has been largely settle for the Eurozone and most of Germany’s significant surplus comes with other countries outside the Eurozone.

The weaker euro is an important factor and it’s here to stay

Leading on from the above, since the trade surplus is largely with

countries outside the Eurozone, one of the key factors is the weaker

euro or more specifically that it is too weak for the German economy.

While it has only weakened substantially recently (since May 2014) it

has been too weak for Germany throughout the crisis. Bernanke does

mention this but fails to really give it the relevance it deserves. It

is of course crucial since there is little Germany can do to counter it

and because the euro is only likely to get weaker due to the ECB’s

looser monetary policy and bond buying.