Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD - waiting for market conditions to normalize into this week

US Dollar - "It is difficult to establish at what level the Dollar’s rally has over-reached its fair value as the Fed’s timetable contrasts its ECB and BoJ peers so definitively. However, there are speculative measures that may offer scale to the market’s appetite to exploit a consistent trend rather than follow due diligence on fundamental value. We have seen the US Dollar’s net speculative futures positions measured by the CFTC’s COT report soar these past 9 months. Having seen the Greenback position level out and some major counterparts (like Yen and Aussie dollar) rebound, we are seeing early stages of rebalancing. This is not unique to the Dollar nor just the FX market. Speculative excess is seen in most markets; and if deleveraging takes traction, the Dollar could suffer as well…until we hit panic levels."

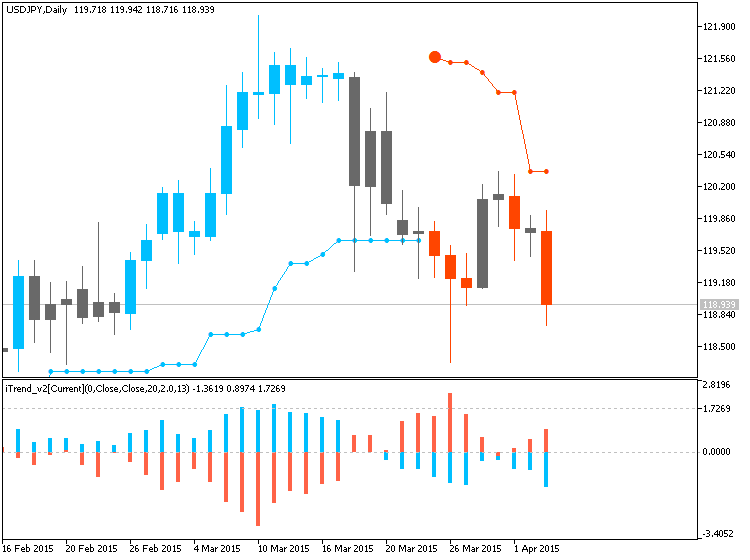

USDJPY - "In turn, more of the same from the BoJ may generate a larger correction in USD/JPY and the pullback from 120.35 may open the door for a test of the March Low (118.32) into the 61.8% Fibonacci retracement (118.20) as the pair carves a series of lower-highs in March. At the same time, we will also keep a close eye on the monthly opening range going into the first full week of April as full market participation returns on Tuesday following the extended holiday weekend, and the recent wave of U.S. dollar weakness may continue to take shape next week as the dismal data prints dampens bets for a mid-2015 Fed rate hike."

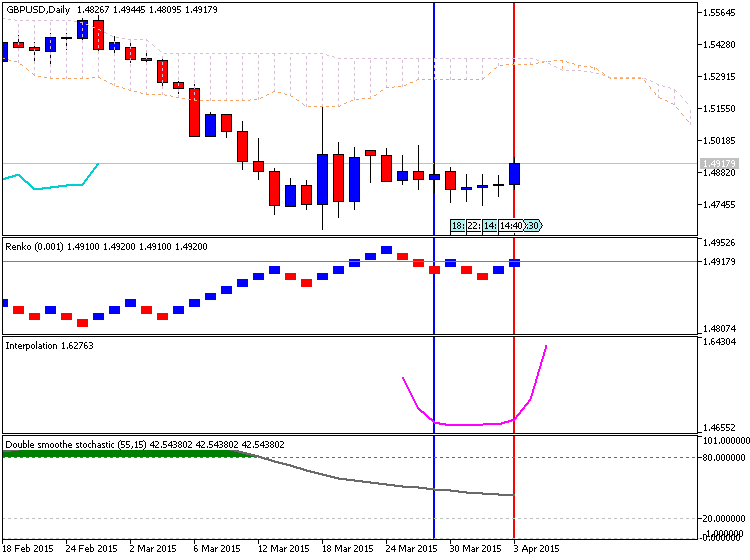

GBPUSD - "A recent US Dollar sell-off has kept the GBP/USD above key support, but the UK currency may continue to underperform against broader G10 counterparts."

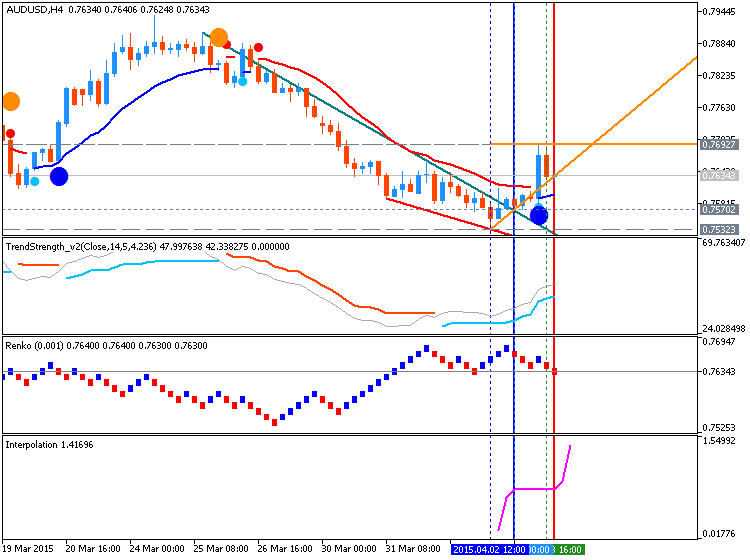

AUDUSD - "RBA may well have warmed up to topping up stimulus. Growth slowed to the weakest in a year in the fourth quarter and the malaise appears to be carrying over into 2015. Overall economic news-flow continues to disappoint relative to consensus forecasts and exports – long a bastion of strength – have fallen for 10 consecutive months compared with a year prior as iron ore prices sank."

XAUUSD

- "Expect price action to spend some time in this range with support & bullish-invalidation

now raised to this week’s low. Initial Resistance is eyed at a longer

dated median-line, currently around 1215 backed by 1223/25 & key

resistance at 1245/48. A break of the lows targets the 1167 support

barrier with subsequent objectives seen at 1150/51 & 1141/42. Bottom

line: waiting for market conditions to normalize into next week with

our outlook weighted to the topside while above 1180."