Why strong greenback is not likely to change Fed's rate hike timing - Research

The threat that the strengthening dollar will push already low inflation

back into negative territory is highly exaggerated, according to a new

research from the Cleveland Fed.

The results could be vital for the timing of the first Fed rate hike since the recession. Fed Chairwoman Janet Yellen stated that before raising interest rates, she wants to be confident that inflation is moving higher towards the U.S. central bank’s 2% annual inflation target.

Thus, an impact from the stronger dollar on inflation could move the Fed to act promptly.

Since last summer, the dollar DXY has risen due to the possibility that the Fed will tighten monetary policy while central banks in Europe and Japan are easing.

Meanwhile, inflation has been moving lower, mainly due to a drop in oil prices. According to government statistics released yesterday, overall inflation is flat in the 12 months ending in February.

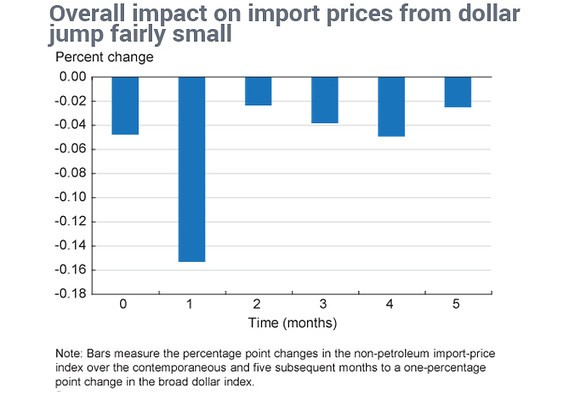

How could the dollar affect inflation? In a new report released Tuesday, the authors said that in general, an increase in the dollar’s exchange rates can affect import prices for at least six months, but the overall impact is fairly small.

Source: MarketWatch

Focusing on non-petroleum imports, they found a 1% gain in the dollar’s exchange rate lowers non-petroleum import prices by 0.3% cumulatively over six months.

The dollar gained 9% against its peers from its low in early July through the end of December. Over the same period, non-petroleum import prices dipped only 1.3%.

According to the researchers, estimating the impact is passed through to consumer prices is more difficult, in part because it depends on why the dollar was rising. But in this case, they found only a small impact on consumer prices.

The consumer price index less energy rose 0.6% in the period between July and January. The found data estimated that absent the drop in non-petroleum import prices from the stronger dollar, the CPI less energy would have risen an additional slim 0.05 to 0.06 percentage point. The impact on the overall CPI would have been slightly less.