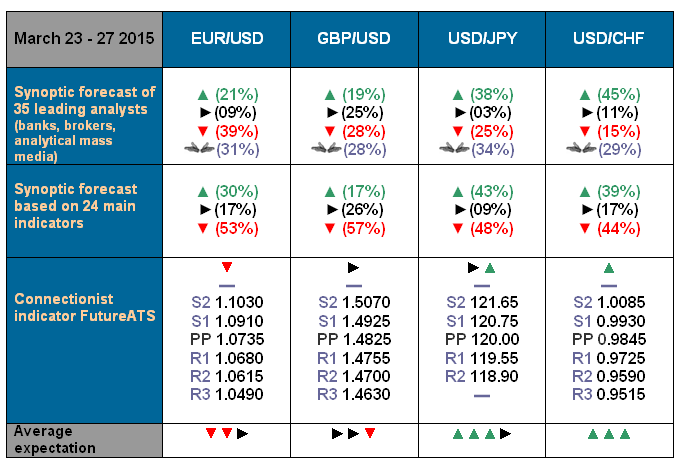

Generalising

the opinions of 35 analysts from world leading banks and broker companies collected

in a table as well as forecasts based on different methods of technical and

graphical analysis, we were

obliged to bring in some innovations. If you look at the analysts’ opinions row

in the table, you will find, along with the symbols indicating increasing,

sideways and decreasing trends, a new symbol - hands . As you can imagine, this

indicates the group of analysts who, being at a total loss, do not know what to

say. And even though this group is quite large (around 30%), there are still a

few desperate predictors whose opinions we take into account when compiling our

forecasts. And so:

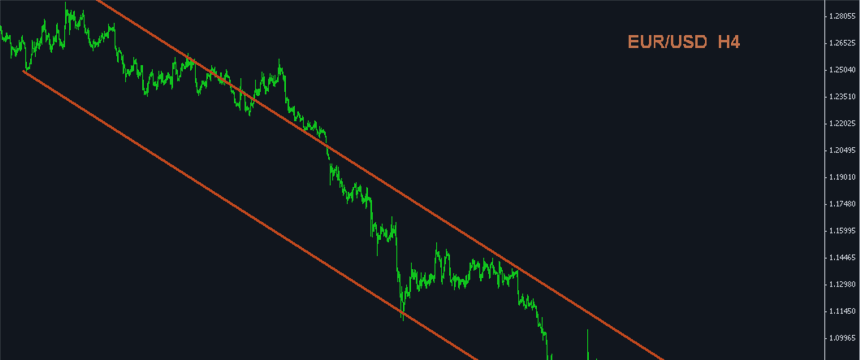

- despite the rebound last week, the main trend of the last few months for the EUR/USD pair remains as is - down to 1.0000. (By the way, the downstream channel that includes all possible fluctuations can be observed very nicely on the H4 graph). Regarding the coming week, a continuation of the short term increasing trend up to the zone of 1.0915÷1.1040 in the start of the week is possible, after which everything should return to normal;

- the GBP/USD pair, yet again, can be expected to repeat EUR/USD’s fluctuations, while at the same time moving in a sideways corridor between 1.4700 and 1.5000, remaining under “bearish” pressure;

- unlike the “Brit”, the USD/JPY pair will, on the contrary, strive upwards, aiming to regain last week’s losses - its nearest target being 121.20. In the meantime neither the indicators or the analysts exclude the possibility that in the first day or two the pair will still continue its fall;

- judging by the indicators, the forecast for the USD/CHF pair is as follows: at first (but not for long) strictly downwards, and then strictly upwards, back to the coveted mark of 1.0000. Considering that the transfer of Friday’s indications to Monday is a churlish task, it is possible that the pair will turn around and move upwards straight away, from the first tick. The analysts, in general, agree with this.

***

As for last week’s forecast:

- the analysts turned out to be right when predicting the behaviour of the EUR/USD pair. Recall that they predicted a rebound of the pair upwards to the level of 1.1000÷1.1200. Truth be told the pair did not reach such heights in the end, but at its peak the magnitude of the rebound was almost 600.0 points;

- regarding the GBP/USD pair, we predicted that the proud Brit will continue to follow in the Euro’s trail, and to see this it suffices to compare last week’s graphs;

- but the USD/JPY pair did not meet our expectations. As predicted, it spent the first half of the week in a lulling sideways trend, remaining in fairly narrow confines - 121.140÷121.50, but following the news of Wednesday evening, instead of flying upwards, it crashed downwards, dashingly breaking through the support in the zone of 120.65÷120.80;

- as for USD/CHF, if its collapse in January was called “Black Thursday”, the events of last Wednesday can be safely dubbed “Dark-Grey Wednesday”. We hope that the dark leaden clouds will soon disperse, and that the Swiss Frank will once again see the infinitely blue Alpine skies.

Roman Butko, NordFX & Sergey Ershov