Abstract

Support vector machines (SVMs) are promising methods for the prediction of -nancial timeseries because they use a risk function consisting of the empirical error and a regularized term which is derived from the structural risk minimization principle. This study applies SVM to predicting the stock price index. In addition, this study examines the feasibility of applying SVM in -nancial forecasting by comparing it withback-propagation neural networks and case-based reasoning. The experimental results show that SVM provides a promising alternative to stock market prediction.

1. Introduction

Stock market prediction is regarded as a challenging task of -nancial time-series prediction. There have been many studies using arti-cial neural networks (ANNs) in this area. A large number of successful applications have shown that ANN can be a very useful tool for time-series modeling and forecasting [24]. The early days of these studies focused on application of ANNs to stock market prediction (for instance [2,6,11,13,19,23]). Recent researchtends to hybridize several arti-cial intelligence (AI) techniques (for instance [10,22]). Some researchers tend to include novel factors in the learning process. Kohara et al. [14] incorporated prior knowledge to improve the performance of stock market prediction. Tsaihet al. [20] integrated the rule-based technique and ANN to predict the direction of the S& P 500 stock index futures on a daily basis.

Quahand Srinivasan [17] proposed an ANN stock selection system to select stocks that are top performers from the market and to avoid selecting under performers. They concluded that the portfolio of the proposed model outperformed the portfolios of the benchmark model in terms of compounded actual returns overtime. Kim and Han [12] proposed a genetic algorithms approach to feature discretization and the determination of connection weights for ANN to predict the stock price index. They suggested that their approach reduced the dimensionality of the feature space and enhanced the prediction performance.

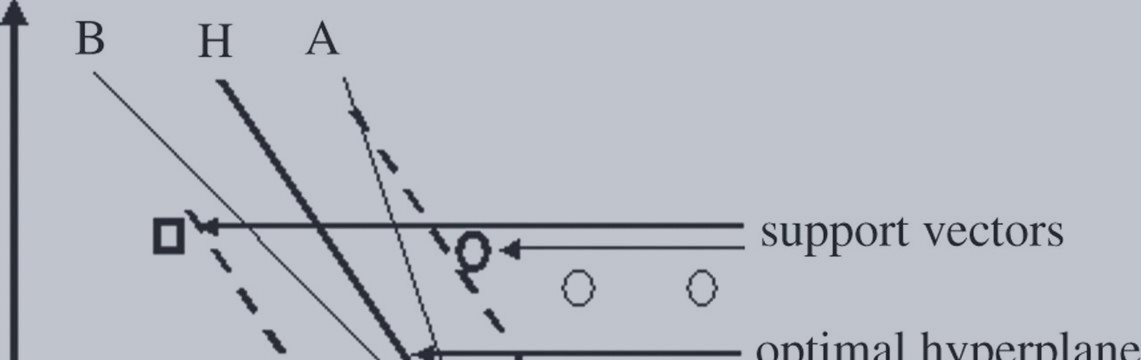

Some of these studies, however, showed that ANN had some limitations in learning the patterns because stock market data has tremendous noise and complex dimensionality. ANN often exhibits inconsistent and unpredictable performance on noisy data. However, back-propagation (BP) neural network, the most popular neural network model, suEers from diFculty in selecting a large number of controlling parameters which include relevant input variables, hidden layer size, learning rate, momentum term. Recently, a support vector machine (SVM), a novel neural network algorithm, was developed by Vapnik and his colleagues [21].

Many traditional neural network models had implemented the empirical risk minimization principle, SVM implements the structural risk minimization principle. The former seeks to minimize the mis-classi-cation error or deviation from correct solution of the training data but the latter searches to minimize an upper bound of generalization error. In addition, the solution of SVM may be global optimum while other neural network models may tend to fall into a local optimal solution. Thus, over-tting is unlikely to occur with SVM. This paper applies SVM to predicting stock price index. In addition, this paper examines the feasibility of applying SVM in -nancial forecasting by comparing it with ANN and case-based reasoning (CBR). This paper consists of -ve sections. Section 2 introduces the basic concept of SVM and their applications in -nance.

Section 3 proposes a SVM approach to the prediction of stock price index. Section 4 describes researchdesign and experiments. In Section 4, empirical results are summarized and discussed. Section 5 presents the conclusions and limitations of this study.